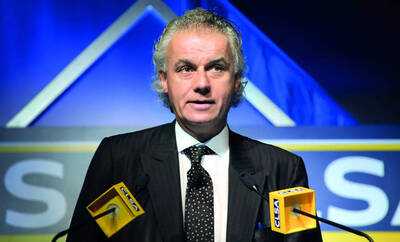

India a 'reverse AI trade' after return disaster in '25: Chris Wood

India has emerged as the “reverse AI trade” within emerging markets after becoming a relative-return disaster in 2025, according to Chris Wood, global head of equity strategy at Jefferies.

In his latest Greed & Fear note, Wood highlighted that India has underperformed the MSCI Emerging Markets Index by a staggering 27 percentage points year-to-date, making it the worst-performing major emerging market. The rupee has also declined 3.4% against the dollar, trading at Rs 88.7.

Wood explained that India’s positioning makes it a contrarian play against the artificial intelligence boom driving valuations in Taiwan, Korea, and China, markets that together account for 61.8% of the MSCI Emerging Markets Index, compared with India’s 15.3% weighting.

"India has become the reverse AI trade, which is another way of saying it should outperform if the AI trade suddenly unwinds, which would be a negative for Taiwan, Korea, and China (in that order)," Wood wrote in his note.

The observation comes as major US hyperscalers face power constraints despite planning aggregate capital expenditure of $360-370 billion in 2025 and around $470 billion in 2026. Wood cited remarks from Microsoft CEO Satya Nadella and Amazon CEO Andrew Jassy on power bottlenecks limiting AI infrastructure deployment, while Nvidia CEO Jensen Huang warned that "China is going to win the AI race" due to lower energy costs.

Despite near-record foreign institutional investor outflows of $16.2 billion year-to-date, India has been a “relative-return disaster” rather than an “absolute-return disaster,” thanks to strong domestic investor demand.

Indian equity mutual funds recorded net inflows of $3.6 billion in October and $42 billion in the first ten months of 2025. Total domestic inflows have averaged an estimated $7.4 billion per month in the first nine months of 2025, effectively offsetting new equity supply of $5.7 billion per month over the past three months.

Wood and Mahesh Nandurkar, Jefferies' head of India research, highlighted several improving macroeconomic indicators suggesting the rupee has likely bottomed around the 89 level.

The strategist expects monetary and credit easing this year, combined with GST rate cuts effective September 22, to boost growth in the coming quarters, particularly nominal GDP growth.

One area of AI vulnerability remains India's IT services sector, where revenue growth slowed to 4% in FY25 and just 1.6% YoY in Q2FY26 ended September 30, leading to a sector de-rating. The BSE IT Index now trades at 23x one-year forward P/E, down from 31x in mid-December.

However, Wood noted that India-based multinational global capability centers (GCCs) have increasingly contributed to the expansion of the services sector, with GCC exports growing in importance relative to IT services exports within India's $388 billion gross service sector exports last fiscal year.

The strategist highlighted Indian property developers as “positively attractive” on valuation, with many trading well below long-term average multiples. Pre-sales for seven major listed developers are on track to grow 22% in value terms in FY26, while combined net debt has fallen sharply from Rs 520 billion in FY19 to an estimated Rs 28 billion by the end of FY26.

The biggest risk to the currency stabilization thesis remains the “continuing resort to handouts in state election politics,” Wood cautioned, citing Bihar’s state election, where parties offered cash handouts of Rs 10,000-30,000 to women under the Mukhyamantri Mahila Rojgar Yojana.

While the central government deficit is forecast at 4.4% of GDP this fiscal year, the combined center-plus-state deficit remains elevated at 7.5% of GDP, with Bihar serving as a case study, India’s poorest state, with a GDP per capita of just Rs 69,321 and a population of 131 million.

The strategist maintains that India remains attractive for long-term investors willing to look beyond near-term underperformance, particularly as a hedge against a potential unwinding of the concentrated AI trade in North Asian technology markets.

In his latest Greed & Fear note, Wood highlighted that India has underperformed the MSCI Emerging Markets Index by a staggering 27 percentage points year-to-date, making it the worst-performing major emerging market. The rupee has also declined 3.4% against the dollar, trading at Rs 88.7.

Wood explained that India’s positioning makes it a contrarian play against the artificial intelligence boom driving valuations in Taiwan, Korea, and China, markets that together account for 61.8% of the MSCI Emerging Markets Index, compared with India’s 15.3% weighting.

"India has become the reverse AI trade, which is another way of saying it should outperform if the AI trade suddenly unwinds, which would be a negative for Taiwan, Korea, and China (in that order)," Wood wrote in his note.

The observation comes as major US hyperscalers face power constraints despite planning aggregate capital expenditure of $360-370 billion in 2025 and around $470 billion in 2026. Wood cited remarks from Microsoft CEO Satya Nadella and Amazon CEO Andrew Jassy on power bottlenecks limiting AI infrastructure deployment, while Nvidia CEO Jensen Huang warned that "China is going to win the AI race" due to lower energy costs.

Despite near-record foreign institutional investor outflows of $16.2 billion year-to-date, India has been a “relative-return disaster” rather than an “absolute-return disaster,” thanks to strong domestic investor demand.

Indian equity mutual funds recorded net inflows of $3.6 billion in October and $42 billion in the first ten months of 2025. Total domestic inflows have averaged an estimated $7.4 billion per month in the first nine months of 2025, effectively offsetting new equity supply of $5.7 billion per month over the past three months.

Wood and Mahesh Nandurkar, Jefferies' head of India research, highlighted several improving macroeconomic indicators suggesting the rupee has likely bottomed around the 89 level.

The strategist expects monetary and credit easing this year, combined with GST rate cuts effective September 22, to boost growth in the coming quarters, particularly nominal GDP growth.

One area of AI vulnerability remains India's IT services sector, where revenue growth slowed to 4% in FY25 and just 1.6% YoY in Q2FY26 ended September 30, leading to a sector de-rating. The BSE IT Index now trades at 23x one-year forward P/E, down from 31x in mid-December.

However, Wood noted that India-based multinational global capability centers (GCCs) have increasingly contributed to the expansion of the services sector, with GCC exports growing in importance relative to IT services exports within India's $388 billion gross service sector exports last fiscal year.

The strategist highlighted Indian property developers as “positively attractive” on valuation, with many trading well below long-term average multiples. Pre-sales for seven major listed developers are on track to grow 22% in value terms in FY26, while combined net debt has fallen sharply from Rs 520 billion in FY19 to an estimated Rs 28 billion by the end of FY26.

The biggest risk to the currency stabilization thesis remains the “continuing resort to handouts in state election politics,” Wood cautioned, citing Bihar’s state election, where parties offered cash handouts of Rs 10,000-30,000 to women under the Mukhyamantri Mahila Rojgar Yojana.

While the central government deficit is forecast at 4.4% of GDP this fiscal year, the combined center-plus-state deficit remains elevated at 7.5% of GDP, with Bihar serving as a case study, India’s poorest state, with a GDP per capita of just Rs 69,321 and a population of 131 million.

The strategist maintains that India remains attractive for long-term investors willing to look beyond near-term underperformance, particularly as a hedge against a potential unwinding of the concentrated AI trade in North Asian technology markets.

Next Story