Will Blackstone's Rs 6,196-crore bet boost Federal Bank?

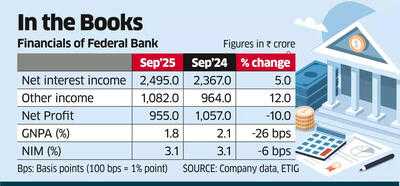

ET Intelligence Group: Shares of Federal Bank have risen 27% over the past three months, including a 9% gain in the past month. The BSE Bankex has gained 9% and 1%, respectively. The lender's outperformance has been driven by global investment giant Blackstone's plan to invest over ₹6,000 crore in the bank and the management's guidance of net interest margin expansion over the next two quarters amid rising focus on high-yield segments.

The bank's board last month approved a preferential issue of warrants to raise ₹6,196.5 crore from Blackstone. As part of the transaction, about 27.3 crore warrants will be issued, each carrying the right to subscribe to one fully paid-up equity share of the bank. "The capital infusion would enable Federal Bank to not only pursue growth in its target segment but also look for inorganic growth opportunities, which complement its existing core strategy," said Axis Securities in a report.

The bank has been focussing on medium and high-yield lending segments, particularly in commercial banking, commercial vehicles, auto loans, loans against property, and gold loan. The private lender expects NIM to improve over the next two quarters as term deposits continue to reprice and CASA (current account saving account) momentum remains strong.

The bank's NIM expanded by 12 basis points sequentially to 3.06% in the September quarter aided by a drop in deposit costs by about 19 bps and a decline in borrowing costs by around 3 bps, resulting in a total 22 bps reduction on the liability side. On the contrary, its yield on advances dropped by 14 bps. Federal Bank is among a few banks that reprice the repo-linked loans on a T+1 basis (the next day after rates are changed). Therefore, most of the impact from the 50 bps change by RBI in June 2025 was absorbed in the previous quarter which also protected its NIM.

Motilal Oswal Financial Services expects an improvement in the bank's return on assets (RoA) from FY27, supported by margin expansion through a stronger asset mix and lower deposit costs as CASA increases. It also estimates around 17% annual growth in loan assets between FY26 and FY28. "We estimate RoA to improve to 1.2% in FY27, with a further rise toward around 1.4% in FY28 and exit RoA potential of around 1.5%," the broker said while retaining a 'Buy' call with a target price of 260. The stock was traded at ₹255.9 at the end of Tuesday's session, up 3.1% from the previous session on the BSE.

The bank's board last month approved a preferential issue of warrants to raise ₹6,196.5 crore from Blackstone. As part of the transaction, about 27.3 crore warrants will be issued, each carrying the right to subscribe to one fully paid-up equity share of the bank. "The capital infusion would enable Federal Bank to not only pursue growth in its target segment but also look for inorganic growth opportunities, which complement its existing core strategy," said Axis Securities in a report.

The bank has been focussing on medium and high-yield lending segments, particularly in commercial banking, commercial vehicles, auto loans, loans against property, and gold loan. The private lender expects NIM to improve over the next two quarters as term deposits continue to reprice and CASA (current account saving account) momentum remains strong.

The bank's NIM expanded by 12 basis points sequentially to 3.06% in the September quarter aided by a drop in deposit costs by about 19 bps and a decline in borrowing costs by around 3 bps, resulting in a total 22 bps reduction on the liability side. On the contrary, its yield on advances dropped by 14 bps. Federal Bank is among a few banks that reprice the repo-linked loans on a T+1 basis (the next day after rates are changed). Therefore, most of the impact from the 50 bps change by RBI in June 2025 was absorbed in the previous quarter which also protected its NIM.

Motilal Oswal Financial Services expects an improvement in the bank's return on assets (RoA) from FY27, supported by margin expansion through a stronger asset mix and lower deposit costs as CASA increases. It also estimates around 17% annual growth in loan assets between FY26 and FY28. "We estimate RoA to improve to 1.2% in FY27, with a further rise toward around 1.4% in FY28 and exit RoA potential of around 1.5%," the broker said while retaining a 'Buy' call with a target price of 260. The stock was traded at ₹255.9 at the end of Tuesday's session, up 3.1% from the previous session on the BSE.

Next Story