How to Activate International Transactions on Your Debit/Credit Card

In today’s globalised world, the need to make international transactions using debit or credit cards has grown significantly. Whether for online shopping from foreign websites, travel, or booking services abroad, ensuring your card is enabled for international transactions is crucial. Many users are unaware that their cards may be blocked for foreign usage by default due to security concerns .

Mobile Banking App: Banks’ mobile apps offer convenient ways to activate international usage. Look for “Card Settings” or “Manage Cards,” then toggle the international transaction option.

Customer Care: Calling the bank’s customer support can also enable international transactions. Agents will verify your identity and activate the service, sometimes instantly.

ATM Activation: Some banks allow international transactions to be activated at ATMs. Insert your card, enter your PIN, and select the option to enable foreign usage.

Why International Transactions May Be Blocked

Banks often restrict international transactions to prevent fraud. By default, many debit and credit cards are only valid for domestic transactions. To use your card abroad or for international online purchases, you must activate the international transaction facility through your bank.Methods to Activate International Transactions

- Net Banking: Most banks allow customers to enable international transactions via net banking. Login to your account, navigate to the card services section, and select the option to enable foreign transactions. You can also set transaction limits if needed.

You may also like

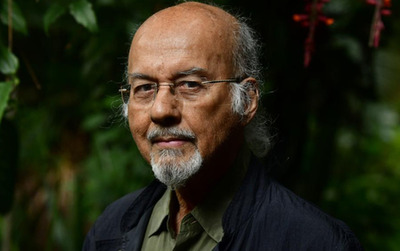

Veteran journalist TJS George passes away in Bengaluru

Veteran journalist TJS George passes away in Bengaluru- BREAKING: Manchester synagogue attack victim Adrian Daulby pictured for first time

- SSC CGLE 2025: Aspirants can review question paper, challenge answer keys at reduced fee

- Roman Kemp reveals he's been asked to do Strictly each year as he shares sad reason for turning it down

- Jharkhand: PM Gram Sadak Yojana transforms Tetariya village of Hazaribagh