How This Government Scheme Can Make You a Crorepati With ₹1 Lakh Monthly Pension

With stock markets showing losses, many investors are now looking for safer ways to grow their money. The National Pension System (NPS) has emerged as a smart option, offering long-term wealth creation along with a steady pension after retirement. Let’s explore how NPS can help you accumulate crores and plan for a financially secure future.

In uncertain market conditions, NPS offers a safe, long-term investment solution. It not only helps you accumulate crores over the years but also secures a reliable pension, ensuring financial stability during retirement. With careful planning, even private sector employees can turn regular monthly contributions into a comfortable, worry-free retirement.

Disclaimer: The information provided in this article is for educational and informational purposes only. We are not encouraging or advising any investment. Readers should consult a certified financial advisor or investment expert before making any financial decisions. Newspoint will not be responsible for any gains, losses, or consequences resulting from investments made based on this information.

Why NPS is a Smart Choice

NPS is open to both government and private sector employees. By contributing a fixed amount every month, you can benefit from market-linked returns, while also enjoying tax exemptions on contributions from both the employee and employer. The scheme allows you to open Tier 1 accounts for retirement savings and Tier 2 accounts for flexible investment. The NPS is designed to make retirement planning simple, convenient, and rewarding.Withdrawal Rules After Retirement

Once you reach 60 years of age, you can withdraw up to 60% of your accumulated savings as a lump sum. The remaining 40% is used to buy an annuity, ensuring you receive a monthly pension . Under the latest rules, if your total NPS deposit is ₹5 lakh or less, you can withdraw the entire amount tax-free without buying an annuity.You may also like

- 'Smart mind behind it': Melania Trump credits Barron for husband's successful Presidential campaign

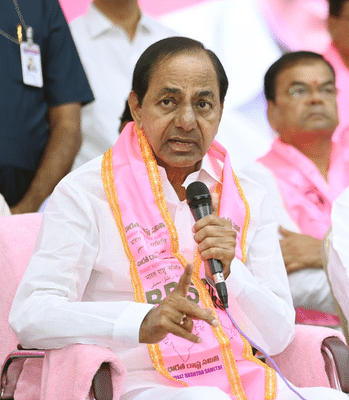

- Rama Rao terms SIT notice to KCR in phone tapping case as 'politics of vendetta'

Delhi LG VK Saxena acquitted in defamation case by activist Medha Patkar

Delhi LG VK Saxena acquitted in defamation case by activist Medha Patkar Former Telangana CM KCR summoned for questioning in phone-tapping case

Former Telangana CM KCR summoned for questioning in phone-tapping case Delhi HC upholds conviction in 1995 CBI bribery trap case, issues key directions on trial procedure

Delhi HC upholds conviction in 1995 CBI bribery trap case, issues key directions on trial procedure

When to Start Investing

Timing plays a key role in maximizing returns. NPS allows up to 75% exposure in equities during the early years, which gradually decreases as you approach retirement. If you start investing at age 35, you can take advantage of higher market exposure, giving your money a longer time to grow.How to Grow Your Wealth to Crores

Consider this scenario: if you start investing at age 40 and deposit ₹20,000 per month, increasing your contribution by 10% every year, and assuming a 10% annual return, your total corpus after 20 years could reach around ₹3.23 crore. Here’s the breakdown:- Total investment: ₹1.37 crore

- Returns earned: ₹1.85 crore

- Tax savings: ₹41.23 lakh

Pension Through Annuity

The remaining 40% of your corpus can be invested in an annuity to provide a monthly pension of around ₹1 lakh. The one-time withdrawal could total ₹1.62 crore, giving you both a lump sum and a steady income stream for life.In uncertain market conditions, NPS offers a safe, long-term investment solution. It not only helps you accumulate crores over the years but also secures a reliable pension, ensuring financial stability during retirement. With careful planning, even private sector employees can turn regular monthly contributions into a comfortable, worry-free retirement.

Disclaimer: The information provided in this article is for educational and informational purposes only. We are not encouraging or advising any investment. Readers should consult a certified financial advisor or investment expert before making any financial decisions. Newspoint will not be responsible for any gains, losses, or consequences resulting from investments made based on this information.