How To Strengthen Income & Secure Your Financial Future

In today’s fast-changing economic environment, having a stable job is a valuable achievement. For most households, monthly salaries take care of essentials such as rent, food, education and routine expenses. However, relying only on one source of income can be risky. Market slowdowns, company restructuring or sudden role changes can disrupt even well-planned finances. This growing uncertainty has made it essential for individuals to think beyond salaries and focus on building income in a more balanced and sustainable way.

Strengthen Your Career As A Financial Base

Your job remains the strongest foundation for income growth. Consistently upgrading your skills, learning new tools and being open to additional responsibilities can significantly improve your value at the workplace. Employers are more likely to reward employees who adapt quickly and contribute beyond their basic role. Over time, this approach leads to better appraisals, promotions and job security. A strong professional reputation also makes it easier to switch roles if market conditions change.Build Wealth Gradually Through Investments

Income growth does not depend only on earning more, but also on managing money wisely. Investing a portion of your earnings allows your money to grow over time. Regular investment habits, such as systematic plans or long-term savings instruments, help create a financial cushion for future needs. While investments may not deliver instant results, they play a critical role in long-term financial planning and reduce dependence on monthly income alone.You may also like

Pakistan Defence Minister admits security forces were 'handicapped' against Baloch rebels

Pakistan Defence Minister admits security forces were 'handicapped' against Baloch rebels Delhi Police Cyber Cell cracks inter-state fraud syndicates, arrests 55

Delhi Police Cyber Cell cracks inter-state fraud syndicates, arrests 55- India-EU FTA will likely get ratified but political factors may play spoilsport

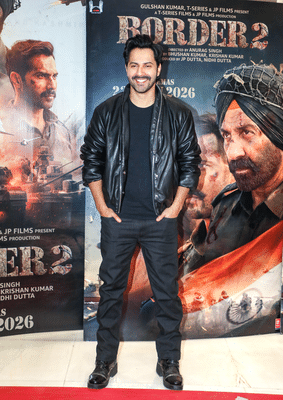

Varun Dhawan shares BTS of 'Border 2' director giving 'finishing touches' to his look

Varun Dhawan shares BTS of 'Border 2' director giving 'finishing touches' to his look- Trump administration faces lawsuit over $1M 'Gold Card' visa programme