Income Tax Relief in Budget 2026? What Salaried Employees Should Know

With just days left for Union Budget 2026 , salaried taxpayers are watching closely for any sign of income tax relief. While expectations of big tax cuts remain low, experts believe the government could still roll out small, targeted measures, especially within the new tax regime, to ease pressure on middle-income earners.

Amid rising expenditure needs and tight fiscal conditions, this year’s budget is expected to prioritise balance and discipline over headline-grabbing giveaways.

“Budget 2026 is expected to continue the government’s gradual move towards making the new tax regime more attractive and widely adopted,,” he said.

However, this shift is expected to be evolutionary, not dramatic. According to Surana, the focus may be on fine-tuning existing provisions rather than introducing sweeping reforms.

“There is a reasonable expectation of marginal rationalisation of slabs to account for inflation and rising living costs, especially for middle-income taxpayers,” he added.

“A major revision of existing income tax slabs appears unlikely in the Union Budget 2026,” he said, pointing out that substantial adjustments have already been made in recent budgets under the new regime.

Any relief, therefore, is more likely to come through modest tweaks aimed at softening the impact of inflation rather than structural overhauls.

“There is a reasonable possibility that the government may consider increasing the standard deduction under the new tax regime,” he said, adding that such a move would offer broad-based relief without complicating the tax framework.

Overall, expectations are set for limited but meaningful relief rather than sweeping concessions.

“The government and the RBI have already implemented measures like personal income tax cuts, GST rationalisation, the 8th Pay Commission and interest rate cuts,” he said.

Given this backdrop, Yadav expects Budget 2026 to focus on fiscal consolidation.

“The budget is likely to be more of a business-as-usual exercise, without any big bang announcements,” he added.

Echoing this view, Gaurav Garg, Research Analyst at Lemonn Markets Desk, said the budget is expected to strike a careful balance.

“With tax revenues under pressure due to last year’s income-tax relief, the government’s focus will be on funding defence, renewable energy and semiconductors without breaking fiscal discipline,” he said.

He added that future growth is likely to rely more on consumption recovery and private investment than aggressive government spending.

The broader message is clear: stability, simplicity and fiscal discipline will take precedence, with only incremental tax relief where possible.

Amid rising expenditure needs and tight fiscal conditions, this year’s budget is expected to prioritise balance and discipline over headline-grabbing giveaways.

New Tax Regime to Remain the Centrepiece

Tax experts say the government is likely to continue nudging taxpayers towards the new tax regime, rather than revamping the old structure. CA (Dr) Suresh Surana believes Budget 2026 will stay on the same path laid out in recent years.“Budget 2026 is expected to continue the government’s gradual move towards making the new tax regime more attractive and widely adopted,,” he said.

However, this shift is expected to be evolutionary, not dramatic. According to Surana, the focus may be on fine-tuning existing provisions rather than introducing sweeping reforms.

“There is a reasonable expectation of marginal rationalisation of slabs to account for inflation and rising living costs, especially for middle-income taxpayers,” he added.

Big Slab Revisions Unlikely

Despite hopes of a major reshuffle in tax slabs, experts remain cautious. Surana noted that the chances of large-scale changes are slim.“A major revision of existing income tax slabs appears unlikely in the Union Budget 2026,” he said, pointing out that substantial adjustments have already been made in recent budgets under the new regime.

Any relief, therefore, is more likely to come through modest tweaks aimed at softening the impact of inflation rather than structural overhauls.

Standard Deduction Could Offer Relief

One area where salaried taxpayers may see some comfort is the standard deduction. Surana believes this could be a practical option for the government.“There is a reasonable possibility that the government may consider increasing the standard deduction under the new tax regime,” he said, adding that such a move would offer broad-based relief without complicating the tax framework.

Overall, expectations are set for limited but meaningful relief rather than sweeping concessions.

Fiscal Constraints Limit Big Announcements

Experts also highlight that the government’s room to announce fresh tax cuts is limited. Alekh Yadav, Head of Investment Products at Sanctum Wealth, pointed out that several supportive measures are already in place.“The government and the RBI have already implemented measures like personal income tax cuts, GST rationalisation, the 8th Pay Commission and interest rate cuts,” he said.

You may also like

Kiccha Sudeep promises to keep working harder as he completes 3 decades in the industry

Kiccha Sudeep promises to keep working harder as he completes 3 decades in the industry Gautam Adani and nephew agree to accept SEC notice in US civil fraud case

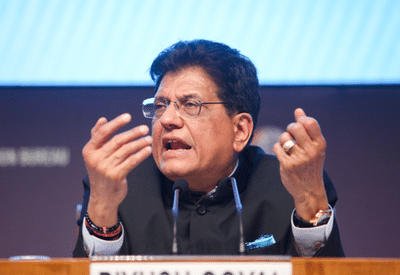

Gautam Adani and nephew agree to accept SEC notice in US civil fraud case IIFT playing an important role in shaping future leaders: Piyush Goyal

IIFT playing an important role in shaping future leaders: Piyush Goyal- 'Ashamed to beg': Shehbaz Sharif details the lengths he and Army chief Munir went to keep Pakistan afloat

"Rajasthan should be granted special status": Congress' Tika Ram Jully urges centre ahead of Budget 2026

"Rajasthan should be granted special status": Congress' Tika Ram Jully urges centre ahead of Budget 2026

Given this backdrop, Yadav expects Budget 2026 to focus on fiscal consolidation.

“The budget is likely to be more of a business-as-usual exercise, without any big bang announcements,” he added.

Echoing this view, Gaurav Garg, Research Analyst at Lemonn Markets Desk, said the budget is expected to strike a careful balance.

“With tax revenues under pressure due to last year’s income-tax relief, the government’s focus will be on funding defence, renewable energy and semiconductors without breaking fiscal discipline,” he said.

He added that future growth is likely to rely more on consumption recovery and private investment than aggressive government spending.

What Taxpayers Can Realistically Expect

Put together, expert opinions suggest that Union Budget 2026 may not bring dramatic income tax cuts. However, small steps, such as a higher standard deduction or minor slab adjustments, could still offer some relief to salaried individuals.The broader message is clear: stability, simplicity and fiscal discipline will take precedence, with only incremental tax relief where possible.