PhonePe Introduces Biometric Security for UPI Payments Up to Rs 5,000: How It Works

India’s digital payments ecosystem continues to evolve rapidly, and PhonePe has now taken another big step forward. The company has introduced biometric authentication for Unified Payments Interface (UPI) transactions, allowing users to approve payments of up to Rs 5,000 using fingerprint or facial recognition instead of entering a UPI PIN each time.

This new feature is designed to make small and frequent payments quicker, smoother, and more secure.

What Exactly Has Changed?

Until now, every UPI transaction required users to enter their UPI PIN for authentication. While this ensures strong security, it can feel repetitive especially for small, everyday payments.

In such cases, repeatedly entering a PIN can be inconvenient. The biometric option removes this extra step for smaller transactions, saving time and reducing friction in daily payments.

It also minimizes failed transactions caused by incorrect PIN entries.

How Secure Is It?

PhonePe has clarified that biometric authentication works as a device-level two-factor authentication mechanism for eligible transactions. Since the feature relies on the phone’s native biometric security system, it maintains high safety standards.

Additionally, there is a built-in fallback option. If biometric verification fails due to low lighting, fingerprint sensor issues, or face recognition limitations, users can switch back to PIN-based authentication instantly.

So even if the biometric system doesn’t work temporarily, transactions won’t be blocked.

Availability

Currently, the feature is available for Android users and supports both fingerprint and facial recognition. The company has confirmed that support for iOS devices will be rolled out soon.

Deep Agrawal, Head of Payments at PhonePe, stated that the goal of this feature is to simplify the payment process while maintaining strong security standards.

Where Can It Be Used?

The biometric authentication feature supports:

This makes it useful for both daily spending and routine banking tasks.

How to Enable Biometric Payments on PhonePe

Activating the feature is simple and takes only a few minutes:

Once enabled, you can approve payments up to Rs 5,000 without entering your PIN every time.

As digital payments continue to dominate India’s financial landscape, innovations like biometric authentication are expected to make transactions not only faster but also more user-friendly while keeping security at the forefront.

This new feature is designed to make small and frequent payments quicker, smoother, and more secure.

What Exactly Has Changed?

Until now, every UPI transaction required users to enter their UPI PIN for authentication. While this ensures strong security, it can feel repetitive especially for small, everyday payments.With the new biometric authentication feature:

- Payments up to Rs 5,000 can be approved using fingerprint or face recognition.

- Payments above Rs 5,000 will still require a UPI PIN, as per regulatory guidelines.

- Users authenticate transactions through their smartphone’s built-in security system.

- This means faster checkouts without compromising safety.

Why This Feature Is Important

UPI usage has grown significantly across India. People now rely on digital payments for:- Grocery shopping

- QR code payments at local stores

- Online shopping

- Peer-to-peer transfers

- Utility bill payments

In such cases, repeatedly entering a PIN can be inconvenient. The biometric option removes this extra step for smaller transactions, saving time and reducing friction in daily payments.

It also minimizes failed transactions caused by incorrect PIN entries.

How Secure Is It?

PhonePe has clarified that biometric authentication works as a device-level two-factor authentication mechanism for eligible transactions. Since the feature relies on the phone’s native biometric security system, it maintains high safety standards. Additionally, there is a built-in fallback option. If biometric verification fails due to low lighting, fingerprint sensor issues, or face recognition limitations, users can switch back to PIN-based authentication instantly.

So even if the biometric system doesn’t work temporarily, transactions won’t be blocked.

You may also like

- "Unfortunately Rahul Gandhi has turned it into political issue," Union Minister G Kishan Reddy on Congress MP's AI Summit remarks

- Shameful experience, says BJP MP after luggage lost on IndiGo Delhi-Belagavi flight

- CONNECT 2026 – Bengaluru: Karnataka Tourism Society Hosts Landmark Stakeholder Meet

Shillong MP Ricky Syngkon's demise: Meghalaya Assembly adjourns Budget Session

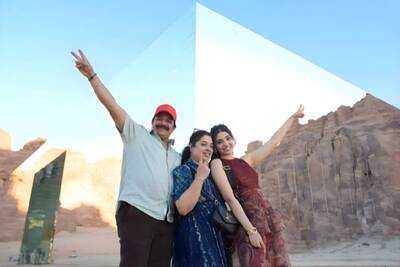

Shillong MP Ricky Syngkon's demise: Meghalaya Assembly adjourns Budget Session Krithi Shetty's Desert Photoshoot Is Breaking the Internet And AlUla Has Never Looked Better

Krithi Shetty's Desert Photoshoot Is Breaking the Internet And AlUla Has Never Looked Better

Availability

Currently, the feature is available for Android users and supports both fingerprint and facial recognition. The company has confirmed that support for iOS devices will be rolled out soon. Deep Agrawal, Head of Payments at PhonePe, stated that the goal of this feature is to simplify the payment process while maintaining strong security standards.

Where Can It Be Used?

The biometric authentication feature supports: - Peer-to-peer transfers

- Merchant QR code payments

- Online transactions

- Bank balance checks

This makes it useful for both daily spending and routine banking tasks.

How to Enable Biometric Payments on PhonePe

Activating the feature is simple and takes only a few minutes:- Open the PhonePe app.

- Go to your Profile section.

- Tap on Manage Payment Settings.

- Select Biometric Pay.

- Enable biometric authentication for your linked bank account.

- Complete a one-time setup using your UPI PIN and biometric verification.

Once enabled, you can approve payments up to Rs 5,000 without entering your PIN every time.

As digital payments continue to dominate India’s financial landscape, innovations like biometric authentication are expected to make transactions not only faster but also more user-friendly while keeping security at the forefront.