Rs 2 Crore In 10 Years Explained With Simple Monthly Investment Strategies

Rising living expenses and lifestyle inflation often make long-term wealth creation feel overwhelming for many households. However, financial experts believe that disciplined investing and clear goal-setting can make even ambitious targets achievable. Building a Rs 2 crore corpus within 10 years may appear unrealistic at first glance, but with structured monthly investments, patience and the power of compounding, this milestone can move from aspiration to reality. The key lies in consistency, informed product selection and regular portfolio review over the investment journey.

Disclaimer: This article is for information purposes only and does not constitute financial advice. Investment decisions should be made based on individual financial goals, risk appetite and consultation with qualified financial experts or advisors. Market-linked investments are subject to risks, and past performance does not guarantee future returns.

Why A Clear Financial Goal Makes All The Difference

According to experts, the foundation of successful investing starts with defining a precise financial objective. When investors set a clear target such as accumulating Rs 2 crore within a fixed timeframe of 10 years, it becomes easier to plan contributions and choose suitable investment instruments. A defined goal also brings focus and discipline, reducing the temptation to skip investments during volatile market phases. Without clarity, investments often remain scattered and fail to deliver meaningful outcomes over the long term.Understanding The Role Of Systematic Investing

Systematic investing, particularly through monthly contributions, allows individuals to build wealth steadily without the stress of timing the market. Financial planners highlight that investing a fixed amount every month helps average out market volatility while encouraging long-term commitment. Over a decade, even moderate annual returns can significantly multiply regular investments, primarily due to compounding. This structured approach is especially effective for salaried individuals seeking predictable and manageable investment habits.Estimating The Monthly Investment Needed

Experts suggest that calculating the required monthly contribution is a crucial step in goal-based planning. For a Rs 2 crore target over 10 years, the monthly investment amount depends on expected returns and individual risk appetite. Assuming an average annual return of around 12 percent, a disciplined investor may need to invest close to Rs 90,000 per month through systematic plans. Over the decade, this results in a total invested amount of roughly Rs 1.08 crore, with returns contributing the remaining growth to cross the Rs 2 crore mark.How Compounding Accelerates Wealth Creation

Compounding plays a powerful role when investments are allowed to grow uninterrupted over long periods. According to experts, the real impact of compounding becomes visible in the later years of the investment horizon. Earnings generated on earlier contributions begin to generate further returns, creating exponential growth. This is why consistency and patience are often valued more than chasing short-term high-return opportunities that may involve higher risk.You may also like

- Iran protest: At least 538 dead in crackdown; Tehran warns US, Israel of consequences

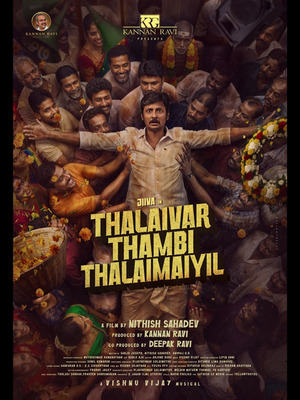

Jiiva-starrer 'Thalaivar Thambi Thalaimaiyil' trailer released

Jiiva-starrer 'Thalaivar Thambi Thalaimaiyil' trailer released- Punjab launches auctions for mining sites across state

- Delhi BJP chief shares Atishi remark video, dares Kejriwal to get him prosecuted

- Jammu and Kashmir: Suspected Pak drones seen hovering over areas along LoC, IB; search operations launched

Choosing Suitable Investment Instruments

While there are multiple investment avenues available in India, equity-oriented mutual funds are often recommended for long-term goals due to their potential to deliver higher inflation-adjusted returns. Compared to traditional instruments such as fixed deposits, equity funds offer better growth prospects over extended periods. However, they are subject to market fluctuations, making it important for investors to align fund selection with their risk tolerance and financial capacity.Importance Of Diversification In A 10-Year Plan

Diversification is another key principle highlighted by financial experts. Spreading investments across different equity segments such as large-cap, mid-cap and small-cap funds can help balance risk and return. Diversification reduces dependency on a single market segment and improves portfolio resilience during economic slowdowns. Investors may also consider maintaining limited exposure to other asset classes depending on their comfort level and long-term strategy.Staying Invested During Market Volatility

Market ups and downs are inevitable over a 10-year period. Experts caution against reacting emotionally to short-term volatility, as frequent entry and exit can dilute long-term returns. Remaining invested during downturns often allows investors to accumulate more units at lower prices, strengthening returns when markets recover. Discipline during uncertain phases is often what separates successful long-term investors from those who fall short of their goals.Regular Review And Course Correction

Although long-term investing requires patience, it does not mean ignoring portfolio performance altogether. Financial advisors recommend reviewing investments periodically to ensure alignment with goals. Changes in income, expenses or market conditions may require adjustments to contribution amounts or fund allocation. Timely rebalancing helps maintain the desired risk profile while keeping the investment plan on track.Why Starting Early Offers A Clear Advantage

According to experts, starting early significantly reduces the financial burden of large monthly investments. A longer horizon allows smaller contributions to grow more efficiently, while delayed investing often requires higher monthly commitments to achieve the same goal. Even a few years of delay can make a substantial difference in the total amount invested over time.The Discipline Factor That Drives Success

Ultimately, the journey towards building a Rs 2 crore corpus depends less on complex strategies and more on sustained discipline. Regular investing, resisting unnecessary withdrawals and maintaining a long-term outlook form the backbone of successful wealth creation. Experts emphasise that consistency often outweighs timing and speculation in achieving meaningful financial milestones.Disclaimer: This article is for information purposes only and does not constitute financial advice. Investment decisions should be made based on individual financial goals, risk appetite and consultation with qualified financial experts or advisors. Market-linked investments are subject to risks, and past performance does not guarantee future returns.