Invest ₹12,500 A Month Under Government Scheme To Build ₹70 Lakh Corpus

Sukanya Samriddhi Yojana : The central government’s Sukanya Samriddhi Yojana has emerged as one of the most trusted savings schemes for securing the financial future of daughters. Designed especially for long-term goals such as education and marriage, the scheme combines safety, steady returns and tax benefits. Backed by the government, it has become a preferred choice for parents looking for a reliable investment option amid rising education costs and future financial responsibilities.

Objective Of Sukanya Samriddhi Yojana

The primary aim of the Sukanya Samriddhi Yojana is to help families create a dedicated financial corpus for their daughters. The scheme encourages parents to start saving early and invest regularly over a long period. Since it is fully government-backed, it offers complete capital safety, making it particularly attractive for middle-class households that prioritise secure and disciplined savings.Eligibility And Account Opening Process

A Sukanya Samriddhi Yojana account can be opened any time from the birth of a girl child until she turns 10 years old. The account is opened by parents or a legal guardian at a post office or authorised bank branch. Only one account is permitted per daughter, ensuring focused savings for each child. Once opened, the account remains active until maturity, provided minimum annual deposits are made.You may also like

SC issues notice in West Bengal SIR dispute, assures protection of voters' rights

SC issues notice in West Bengal SIR dispute, assures protection of voters' rights- SaaS AI threat rattles US, India IT stocks; Infosys dips over 8 pc

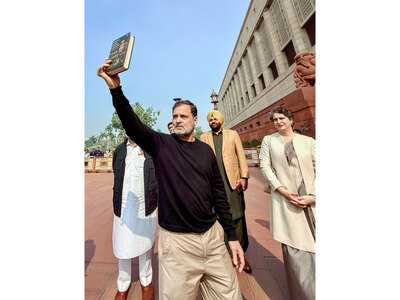

Rahul Gandhi says, "I will present Gen Naravane's memoir to PM Modi," criticises handling of national security

Rahul Gandhi says, "I will present Gen Naravane's memoir to PM Modi," criticises handling of national security- India nears Naxal-free milestone as security forces enter final phase

- Manipur BJP leader Yumnam Khemchand Singh meets Governor Ajay Bhalla, stakes claim to form NDA government