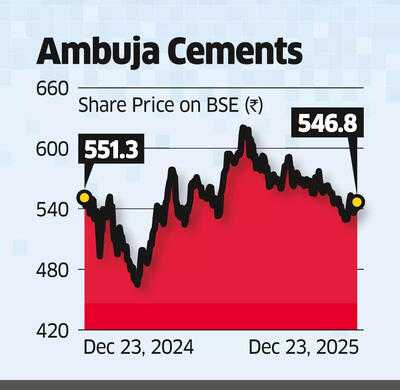

Adani's cement biz merger to benefit Ambuja shareholder

Mumbai: Analysts see the proposed merger within the Adani Group's cement businesses as favourable for Ambuja Cements' shareholders, saying it removes the long-standing overhang of managing multiple listed cement companies and simplifies the group structure. Analysts said the share-swap ratios are neutral for ACC's minority shareholders and positive for those of Orient Cement. The proposed deal outlines a share-swap ratio of 328 Ambuja shares for every 100 shares of ACC and 33 Ambuja shares for every 100 shares of Orient Cement. A look at what some of the leading brokerages are saying about the merger deal.

Morgan Stanley

JP Morgan

CLSA

Axis Cap

Morgan Stanley

- Should be favourable for Ambuja shareholders; removes the overhang of managing multiple listed companies under Ambuja.

- Share swap ratios neutral for ACC minority shareholders and positive for Orient minority shareholders.

JP Morgan

- Integrated pan India operations should help Ambuja optimise costs and improve sale of more premium brands over time.

- Group structure should simplify materially post merger; understanding company reporting (results, volumes, margins) should become easier.

CLSA

- With ACC trading at a sharp discount to Ambuja, this implies value accretion for Ambuja shareholders

- Rating Ambuja an 'outperform', while placing a 'hold' recommendation on ACC.

Axis Cap

- Merger will not have any meaningful impact earnings estimates but will simplify corporate structure and reduce concerns on inter-company transactions.

- Announced swap ratio implies a nil upside for ACC and a 9% upside for Orient.

Next Story