Can M&M Fin sustain 27% rally amid improving margins?

ET Intelligence Group: Shares of Mahindra & Mahindra Financial Services (MMFS), the largest financier of tractors, have surged 27% over the past three months, including a 13% gain over the past month. The ET NBFC index has gained 4% and 2.3% during the said periods respectively. A strong second-quarter performance boosted by robust traction in the auto financing business following a rate cut in the goods and services tax (GST) aided the stock's outperformance.

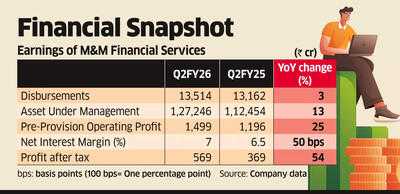

The company reported 13% year-on-year growth in assets under management (AUM) and a healthy expansion in net interest margin (NIM) for the quarter, aided by a reduction in cost of funds. The momentum is likely to continue in the coming quarters.

NIM improved to 7% in the September quarter from 6.5% a year ago, supported by higher fee-based income and dividend inflows from its wholly owned insurance subsidiary Mahindra Insurance Brokers. The company expects to maintain NIM at the current level in the medium term. A 30 bps decline in cost of funds also contributed to margin gains, with the company benefiting from a funding mix where around 41% of borrowings are floating-rate while lending remains largely fixed-rate.

Analysts expect the company's return on assets (RoA) to improve over the medium term, following three consecutive years of decline. RoA fell to 1.9% in FY25, from 1.7% in FY24 and from 2.3% in FY23.

PL Capital expects the company's RoA to trend higher over the medium term, driven by improving spreads and lower credit costs. "Company expects credit cost to improve to 1.3%-1.7% over the long term, resulting in RoA improving to 2.2%-2.5%. We expect RoA to improve to 2.1% by FY28E, led by the improvement in spread and credit cost," the broking firm said in a report. It has upgraded the stock's target price to ₹375 from ₹300.

Motilal Oswal Financial Services expects net profit to increase by 19% annually between FY25 and FY28 and projects return on assets and return on equity to improve to 2.2% and 14%, respectively by FY28, reiterating its buy rating with a target price of ₹400.

The company reported 13% year-on-year growth in assets under management (AUM) and a healthy expansion in net interest margin (NIM) for the quarter, aided by a reduction in cost of funds. The momentum is likely to continue in the coming quarters.

NIM improved to 7% in the September quarter from 6.5% a year ago, supported by higher fee-based income and dividend inflows from its wholly owned insurance subsidiary Mahindra Insurance Brokers. The company expects to maintain NIM at the current level in the medium term. A 30 bps decline in cost of funds also contributed to margin gains, with the company benefiting from a funding mix where around 41% of borrowings are floating-rate while lending remains largely fixed-rate.

Analysts expect the company's return on assets (RoA) to improve over the medium term, following three consecutive years of decline. RoA fell to 1.9% in FY25, from 1.7% in FY24 and from 2.3% in FY23.

PL Capital expects the company's RoA to trend higher over the medium term, driven by improving spreads and lower credit costs. "Company expects credit cost to improve to 1.3%-1.7% over the long term, resulting in RoA improving to 2.2%-2.5%. We expect RoA to improve to 2.1% by FY28E, led by the improvement in spread and credit cost," the broking firm said in a report. It has upgraded the stock's target price to ₹375 from ₹300.

Motilal Oswal Financial Services expects net profit to increase by 19% annually between FY25 and FY28 and projects return on assets and return on equity to improve to 2.2% and 14%, respectively by FY28, reiterating its buy rating with a target price of ₹400.

Next Story