Cement stocks: Is the slump over?

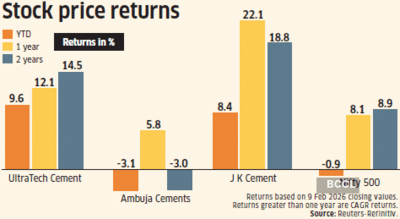

Cement stocks could see a turnaround after a difficult few quarters when the industry’s pricing power was constrained by competition, aggressive capacity additions, muted demand, and a focus on driving volumes rather than margins. This weakness was reflected in the share price performance. Over the past year, a basket of 27 cement companies (each with a market cap above Rs.500 crore) delivered an equal-weighted average return of –4.3%, trailing the Nifty 500 index, which gained 8.1%. Nearly 17 companies posted negative returns, while 19 underperformed the benchmark as of 6 February 2026. However, the worst may be behind the sector.

Signs of revival

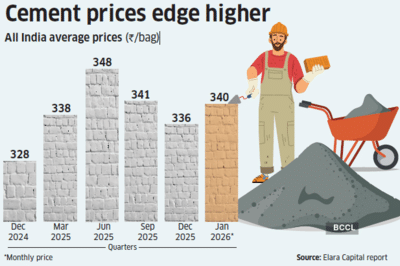

The fourth quarter of 2025-26 has lifted sentiment. Cement companies raised prices in January, with further hikes expected in February. Peak construction season (January–June), steady housing demand and government infrastructure spending are supporting the recovery, though the sustainability of price gains remains a key monitorable. Centrum Broking reports that all-India cement prices in January 2026 rose by Rs.5 per bag in the trade (retail) segment, while non-trade (institutional) prices climbed by Rs.10–20 per bag across most regions. Brokerages including Axis Securities, Systematix, Motilal Oswal, Anand Rathi, Centrum Broking and HDFC Securities remain constructive on the sector, citing expectations of stronger central and state capital expenditure (capex), sustained housing activity, stable costs, seasonal recovery, a rural rebound and attractive valuations. In the December 2025 quarter, cement companies delivered solid results driven by higher volumes. Axis Securities noted that companies in its coverage universe exceeded expectations on volumes, revenue and EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation).

Margins and costs

Operating margins appear to have bottomed out in the December 2025 quarter. Elara Capital expects margins to improve in March 2026, aided by operating leverage and modest price hikes, with stronger expansion likely in Q1 2026-27 as larger price increases take hold.

Cost dynamics remain favourable. Petcoke and imported coal—key cement inputs—are range-bound, with petcoke at $110–130 per tonne (Rs.9,900-11,700/ tonne) and domestic coal and power costs stable. As a result, EBITDA per tonne, which had fallen to Rs.750-900 in 2024-25, is recovering toward Rs.900-1,100, says Bhavik Joshi, Business Head, INVasset PMS. Additionally, greater reliance on low-cost renewable energy is emerging as a structural tailwind. HDFC Securities notes that adoption of green energy, alongside logistics efficiency initiatives, should drive margin expansion through 2025-26 and 2027-28. The brokerage projects average net sales realisation to rise by 1.5% in both FYs, 2026-27 and 2027-28.

Axis Securities also highlights the recent GST rate cut to 18% (from 28%) as a long-term growth driver. Lower consumer prices are expected to stimulate demand (especially in rural and semi-urban housing) and thus help volumes over the medium term. It will encourage premium brand adoption and benefit Tier 1 players with stronger brand portfolios.

Valuations

Sector valuations have improved after recent underperformance, though analysts stress they remain stock-specific. Distribution strength, pricing power, regional mix and capacity expansion visibility are key differentiators. Markets appear to be pricing in medium-term demand from infrastructure and housing, while staying cautious on near-term pricing volatility and capacity additions.

Cement prices edge higher

All India average prices (Rs/bag)

Investment approach

India’s infrastructure and housing momentum supports the sector’s long-term prospects. Vincent K. A., Senior Research Analyst at Geojit Investments, advocates a stock-specific approach focused on valuations, earnings growth and execution. Joshi adds that cement is a cyclical allocation where cycle awareness matters more than timing, advising investors to treat it as a portfolio stabiliser tied to domestic growth. Key risks include capacity-led competition, demand slowdown and cost volatility.

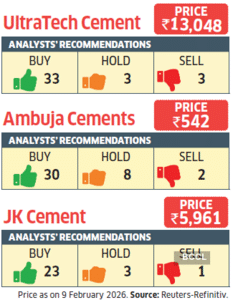

Here is how three cement stocks with the highest number of buy ratings are placed.

UltraTech Cement

Signs of revival

The fourth quarter of 2025-26 has lifted sentiment. Cement companies raised prices in January, with further hikes expected in February. Peak construction season (January–June), steady housing demand and government infrastructure spending are supporting the recovery, though the sustainability of price gains remains a key monitorable. Centrum Broking reports that all-India cement prices in January 2026 rose by Rs.5 per bag in the trade (retail) segment, while non-trade (institutional) prices climbed by Rs.10–20 per bag across most regions. Brokerages including Axis Securities, Systematix, Motilal Oswal, Anand Rathi, Centrum Broking and HDFC Securities remain constructive on the sector, citing expectations of stronger central and state capital expenditure (capex), sustained housing activity, stable costs, seasonal recovery, a rural rebound and attractive valuations. In the December 2025 quarter, cement companies delivered solid results driven by higher volumes. Axis Securities noted that companies in its coverage universe exceeded expectations on volumes, revenue and EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation).

Margins and costs

Operating margins appear to have bottomed out in the December 2025 quarter. Elara Capital expects margins to improve in March 2026, aided by operating leverage and modest price hikes, with stronger expansion likely in Q1 2026-27 as larger price increases take hold.

Cost dynamics remain favourable. Petcoke and imported coal—key cement inputs—are range-bound, with petcoke at $110–130 per tonne (Rs.9,900-11,700/ tonne) and domestic coal and power costs stable. As a result, EBITDA per tonne, which had fallen to Rs.750-900 in 2024-25, is recovering toward Rs.900-1,100, says Bhavik Joshi, Business Head, INVasset PMS. Additionally, greater reliance on low-cost renewable energy is emerging as a structural tailwind. HDFC Securities notes that adoption of green energy, alongside logistics efficiency initiatives, should drive margin expansion through 2025-26 and 2027-28. The brokerage projects average net sales realisation to rise by 1.5% in both FYs, 2026-27 and 2027-28.

Axis Securities also highlights the recent GST rate cut to 18% (from 28%) as a long-term growth driver. Lower consumer prices are expected to stimulate demand (especially in rural and semi-urban housing) and thus help volumes over the medium term. It will encourage premium brand adoption and benefit Tier 1 players with stronger brand portfolios.

Valuations

Cement prices edge higher

All India average prices (Rs/bag)

Investment approach

India’s infrastructure and housing momentum supports the sector’s long-term prospects. Vincent K. A., Senior Research Analyst at Geojit Investments, advocates a stock-specific approach focused on valuations, earnings growth and execution. Joshi adds that cement is a cyclical allocation where cycle awareness matters more than timing, advising investors to treat it as a portfolio stabiliser tied to domestic growth. Key risks include capacity-led competition, demand slowdown and cost volatility.

Here is how three cement stocks with the highest number of buy ratings are placed.

UltraTech Cement

- Revenue and EBITDA exceeded Reuters-Refinitiv estimates by 3.8% and 6.8%, respectively.

- Strong volume growth and cost optimisation supported the performance.

- Infrastructure-led demand, price recovery, improved fuel mix, and operating leverage expected to drive future performance.

- Capacity expansion and integration of Kesoram and India Cements will enhance volumes, EBITDA, and earnings growth.

- Diversification into cables & wires adds long-term earnings visibility.

- Revenue matched Reuters-Refinitiv estimates, but EBITDA missed by 28% due to higher operating costs and one-off expenses.

- Demand outlook remains positive, supported by investments in roads, railways, and commercial projects.

- Management expects price improvement in March 2026 quarter and has guided double-digit volume growth in 2025-26.

- Cost reduction initiatives in power, fuel, logistics, and raw materials are expected to improve margins.

- Revenue and EBITDA surpassed Reuters-Refinitiv estimates by 7.7% and 0.5%, respectively.

- Strong demand-driven volume growth supported performance.

- Ongoing capacity expansion and rampup of newly commissioned plants will fuel future growth.

- Price hikes in the non-trade segment and seasonal demand are expected to boost near-term earnings.

- Elara Capital expects further improvement in upcoming quarters.

Next Story