How Gen Z is powering a digital SIP revolution

Banks and large national distributors—seven and 13, respectively—remain the largest mutual fund distributors in India by assets under management, according to the Association of Mutual Funds in India (Amfi)’s annual commission disclosures.

But fintech platforms are capturing the incremental flows. Industry data shows that eight of the 21 distributors with the highest number of new Systematic Investment Plan (SIP) registrations in October 2025 were fintech players. Fourteen of the top 50 distributors by SIP collections were fintech platforms, including the largest, which recorded realised SIP inflows of Rs 3,461 crore in October.

Higher incremental inflows and a faster pace of new SIP registrations at fintech firms point to a clear trend: Gen Z investors are entering mutual funds rapidly. Nearly 48% of PhonePe Wealth’s mutual fund investors are under the age of 30, says Nilesh D. Naik, head of investment products at Share.Market (PhonePe Wealth). The age profile of National Stock Exchange (NSE) investors shows a clear shift towards a younger population. Nearly 38% of investors registered on the NSE are under 30 years old, up from 22.6% in March 2019. Gen Z refers to those born between 1997 and 2012.

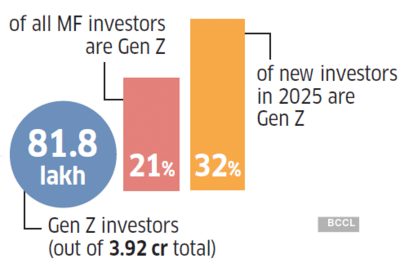

Data from Computer Age Management Services ( CAMS), India’s largest registrar and transfer agent (RTA) by assets under management (AUM), shows that of the 3.92 crore mutual fund investors in CAMS-managed funds, 81.8 lakh—or 21%—are Gen Z investors. In 2025, through October, 32% of new investors entering CAMSserviced mutual funds were Gen Z.

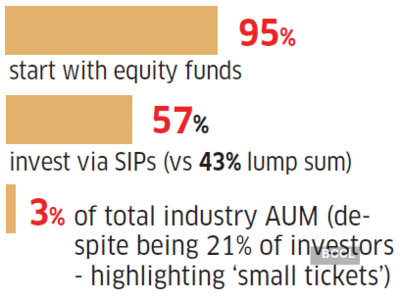

Where do they invest? “Gen Z investors prefer to invest in equity-oriented products; nearly 95% of Gen Z begin their investment journey in mutual funds through equity. This could be due to their higher risk appetite, influenced by the post-Covid bull market and/or lower investment ticket size,” says Naik.

“Gen Z enter stock markets earlier than previous generations. Stocks and mutual fund SIPs are no longer seen as complex or intimidating, they are the default choices,” says Sandiip Bharadwaj, Managing Director and Chief Executive Officer, Paytm Money. “Gen Z’s investment behaviour points to a structural shift in savings. Despite smaller ticket sizes, they are entering the mutual fund ecosystem early, with a preference for SIPs, contributing close to one-fourth of incremental SIP registrations this year, signalling disciplined, long-term intent over market timing,” adds Anuj Kumar, Managing Director, CAMS. Bharadwaj says that the playbook of Gen Z is goal-based and automated. “Emergency funds, experiences and long-term wealth creation co-exist, driven by SIPs, recurring investments, and simple digital tools that offer flexibility and visibility,” he adds.

Young, digital and beyond big cities

Gen Z Is powering the shift to digital-first mutual fund investing.

The growing force

Investment behaviour

The digital edge

81% from beyond top 30 cities

48% of PhonePe investors under 30

Mobilefirst, DIY investing

The fintech story

Choosing DIY investing

Harsh Jain, Co-founder and Chief Operating Officer of Groww—one of India’s largest online mutual fund investment platforms that also runs a mutual fund house—says Gen Z investors are distinctly tech-driven and prefer a DIY (do-it-yourself) approach to investing.

Bharadwaj adds that Gen Z has a mobilefirst mindset. “They expect investing to be intuitive, low-cost, and seamlessly integrated into their everyday digital lives,” he says. This explains why fintech platforms such as PhonePe, Paytm Money, ET Money, Upstox, Zerodha, and others attract a significant share of new SIP registrations.

Around 61% of CAMS-serviced mutual fund inflows come through direct plans. Many fintech apps operate as Execution Only platforms, a mutual fund distribution model that enables them to offer direct plans; they either charge investors a small convenience fee or are compensated by fund houses.

Beyond investing online, Gen Z strongly prefer the SIP route. Small-ticket SIPs that automate monthly investing suit their needs. Data from CAMS shows that 57% of Gen Z investors use SIPs, while the rest invest via lump sum routes. On PhonePe Wealth’s platform, over 90% of Gen Z investors invest through SIPs, says Naik. “Index funds and ETFs are gaining traction for long-term investing, while digital gold is emerging as a low-friction hedge,” adds Bharadwaj.

Gen Z investors are not confined to large cities, says Naik. A 2025 Share.Market (PhonePe Wealth) study found that 81% of young investors came from beyond top 30 (B30) cities such as Jodhpur, Raipur and Visakhapatnam. The study, which analysed over six lakh mutual fund investors, also found that 48% were aged 18-30.

But fintech platforms are capturing the incremental flows. Industry data shows that eight of the 21 distributors with the highest number of new Systematic Investment Plan (SIP) registrations in October 2025 were fintech players. Fourteen of the top 50 distributors by SIP collections were fintech platforms, including the largest, which recorded realised SIP inflows of Rs 3,461 crore in October.

Higher incremental inflows and a faster pace of new SIP registrations at fintech firms point to a clear trend: Gen Z investors are entering mutual funds rapidly. Nearly 48% of PhonePe Wealth’s mutual fund investors are under the age of 30, says Nilesh D. Naik, head of investment products at Share.Market (PhonePe Wealth). The age profile of National Stock Exchange (NSE) investors shows a clear shift towards a younger population. Nearly 38% of investors registered on the NSE are under 30 years old, up from 22.6% in March 2019. Gen Z refers to those born between 1997 and 2012.

Data from Computer Age Management Services ( CAMS), India’s largest registrar and transfer agent (RTA) by assets under management (AUM), shows that of the 3.92 crore mutual fund investors in CAMS-managed funds, 81.8 lakh—or 21%—are Gen Z investors. In 2025, through October, 32% of new investors entering CAMSserviced mutual funds were Gen Z.

Where do they invest? “Gen Z investors prefer to invest in equity-oriented products; nearly 95% of Gen Z begin their investment journey in mutual funds through equity. This could be due to their higher risk appetite, influenced by the post-Covid bull market and/or lower investment ticket size,” says Naik.

“Gen Z enter stock markets earlier than previous generations. Stocks and mutual fund SIPs are no longer seen as complex or intimidating, they are the default choices,” says Sandiip Bharadwaj, Managing Director and Chief Executive Officer, Paytm Money. “Gen Z’s investment behaviour points to a structural shift in savings. Despite smaller ticket sizes, they are entering the mutual fund ecosystem early, with a preference for SIPs, contributing close to one-fourth of incremental SIP registrations this year, signalling disciplined, long-term intent over market timing,” adds Anuj Kumar, Managing Director, CAMS. Bharadwaj says that the playbook of Gen Z is goal-based and automated. “Emergency funds, experiences and long-term wealth creation co-exist, driven by SIPs, recurring investments, and simple digital tools that offer flexibility and visibility,” he adds.

Young, digital and beyond big cities

Gen Z Is powering the shift to digital-first mutual fund investing.

The growing force

Investment behaviour

The digital edge

81% from beyond top 30 cities

48% of PhonePe investors under 30

Mobilefirst, DIY investing

The fintech story

- 8 of 21 largest SIP distributors are fintechs. Direct plans dominate (61% of flows)

- Highest SIP inflows in Oct

- A fintech Rs.3,461cr

Choosing DIY investing

Harsh Jain, Co-founder and Chief Operating Officer of Groww—one of India’s largest online mutual fund investment platforms that also runs a mutual fund house—says Gen Z investors are distinctly tech-driven and prefer a DIY (do-it-yourself) approach to investing.

Bharadwaj adds that Gen Z has a mobilefirst mindset. “They expect investing to be intuitive, low-cost, and seamlessly integrated into their everyday digital lives,” he says. This explains why fintech platforms such as PhonePe, Paytm Money, ET Money, Upstox, Zerodha, and others attract a significant share of new SIP registrations.

Around 61% of CAMS-serviced mutual fund inflows come through direct plans. Many fintech apps operate as Execution Only platforms, a mutual fund distribution model that enables them to offer direct plans; they either charge investors a small convenience fee or are compensated by fund houses.

Beyond investing online, Gen Z strongly prefer the SIP route. Small-ticket SIPs that automate monthly investing suit their needs. Data from CAMS shows that 57% of Gen Z investors use SIPs, while the rest invest via lump sum routes. On PhonePe Wealth’s platform, over 90% of Gen Z investors invest through SIPs, says Naik. “Index funds and ETFs are gaining traction for long-term investing, while digital gold is emerging as a low-friction hedge,” adds Bharadwaj.

Gen Z investors are not confined to large cities, says Naik. A 2025 Share.Market (PhonePe Wealth) study found that 81% of young investors came from beyond top 30 (B30) cities such as Jodhpur, Raipur and Visakhapatnam. The study, which analysed over six lakh mutual fund investors, also found that 48% were aged 18-30.

Next Story