Is Bank Nifty set for more gains as margin pressure eases?

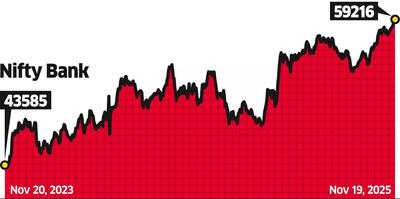

Mumbai: Bank Nifty crossed the 59,000-mark for the first time and closed at a record high on Wednesday, as investor optimism in banking stocks strengthened on expectations that earnings pressure from the interest rate cut cycle has bottomed out and valuations remain relatively modest compared to other sectors.

The index ended 0.5% higher at an all-time closing high of 59,216, while the benchmark Nifty advanced 0.6% to 26,052.

"The momentum in banking stocks is expected to continue, with modest gains likely as valuations remain reasonable," said Pankaj Pandey, head of retail research, ICICI Direct.

Out of the 12 stocks in the index, 10 advanced and two declined. Punjab National Bank gained 2.4%, while Bank of Baroda and Canara Bank rose 1.8% and 0.9%, respectively.

Fund managers said the pressure on profitability is easing.

"The worst of the margin pressure is behind us, and the margins are anticipated to remain stable (unless there are further rate cuts) in the near term after a few quarters of decline," said Christy Mathai, fund manager, Quantum Mutual Fund.

In the past month, the Bank Nifty gained 2.6%, compared with a 1.3% rise in the benchmark Nifty. So far in 2025, Bank Nifty is up 16%, versus a 9.7% gain in the Nifty.

"Foreign investors are no longer negative on the BFSI space as banking stocks displayed improved profitability and relatively lower margin compression," said Pankaj Pandey, head of Retail Research, ICICI Direct.

The Nifty Private Bank and Nifty PSU Bank indices gained 0.3% and 1.2%, respectively, on Wednesday.

Pandey added that the asset quality and growth of PSU banks are now at par with private peers and that improving return ratios leave room for a re-rating.

"Although the entire banking pack witnessed low growth, the margin stability for PSU Banks positively surprised investors," said Mathai.

The index ended 0.5% higher at an all-time closing high of 59,216, while the benchmark Nifty advanced 0.6% to 26,052.

"The momentum in banking stocks is expected to continue, with modest gains likely as valuations remain reasonable," said Pankaj Pandey, head of retail research, ICICI Direct.

Out of the 12 stocks in the index, 10 advanced and two declined. Punjab National Bank gained 2.4%, while Bank of Baroda and Canara Bank rose 1.8% and 0.9%, respectively.

Fund managers said the pressure on profitability is easing.

"The worst of the margin pressure is behind us, and the margins are anticipated to remain stable (unless there are further rate cuts) in the near term after a few quarters of decline," said Christy Mathai, fund manager, Quantum Mutual Fund.

In the past month, the Bank Nifty gained 2.6%, compared with a 1.3% rise in the benchmark Nifty. So far in 2025, Bank Nifty is up 16%, versus a 9.7% gain in the Nifty.

"Foreign investors are no longer negative on the BFSI space as banking stocks displayed improved profitability and relatively lower margin compression," said Pankaj Pandey, head of Retail Research, ICICI Direct.

The Nifty Private Bank and Nifty PSU Bank indices gained 0.3% and 1.2%, respectively, on Wednesday.

Pandey added that the asset quality and growth of PSU banks are now at par with private peers and that improving return ratios leave room for a re-rating.

"Although the entire banking pack witnessed low growth, the margin stability for PSU Banks positively surprised investors," said Mathai.

Next Story