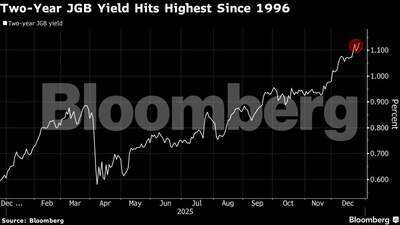

Japan 2-year bond yield rises after tepid auction demand

Tokyo: Japan's two-year government bond yield rose after an auction of the tenor drew weak demand amid speculation that the Bank of Japan may need to raise interest rates more aggressively to rein in inflation and support the yen. The bid-to-cover ratio, a key gauge of demand, was at 3.26, compared with 3.53 at the previous sale and a 12-month average of 3.65. The two-year yield jumped 2.5 basis point to 1.125%, its highest level since 1996. Ten-year bond futures fell after opening higher.

The auction comes less than a week after the BOJ lifted its policy rate to a three-decade high. In comments afterward, Governor Kazuo Ueda offered little guidance on the central bank's future rate path, weakening the yen and sending yields sharply higher.

"There are lingering concerns about the BOJ being behind the curve," said Katsutoshi Inadome, a senior strategist at Sumitomo Mitsui Trust Asset Management Co. "This likely prompted investors to shy away from two-year bonds, which are impacted most by such risks."

The 10-year breakeven inflation rate - an important gauge of market expectations for future price pressures - jumped to the highest level in data going back to 2004 this week.

Still, the yen's depreciation and rising yields have calmed down since the start of the week after Japan's Finance Minister Satsuki Katayama warned that Japan has a "free hand" to take bold action against currency moves that aren't in line with fundamentals.

Investors will be paying attention to the government’s bond issuance plans tied to the fiscal 2026 budget, which is expected to be approved by the Cabinet on Friday. Japan’s primary dealers said this month that more issuance of two-, five- and 10-year government bonds is desirable for next fiscal year starting April 1, while calling for a reduction in sales of super-long debt.

Japan will likely reduce new issuance of super-long government bonds next fiscal year to around 17 trillion yen ($109 billion), the lowest level in 17 years, Reuters reported, citing two unidentified government officials.

The auction comes less than a week after the BOJ lifted its policy rate to a three-decade high. In comments afterward, Governor Kazuo Ueda offered little guidance on the central bank's future rate path, weakening the yen and sending yields sharply higher.

"There are lingering concerns about the BOJ being behind the curve," said Katsutoshi Inadome, a senior strategist at Sumitomo Mitsui Trust Asset Management Co. "This likely prompted investors to shy away from two-year bonds, which are impacted most by such risks."

The 10-year breakeven inflation rate - an important gauge of market expectations for future price pressures - jumped to the highest level in data going back to 2004 this week.

Still, the yen's depreciation and rising yields have calmed down since the start of the week after Japan's Finance Minister Satsuki Katayama warned that Japan has a "free hand" to take bold action against currency moves that aren't in line with fundamentals.

Investors will be paying attention to the government’s bond issuance plans tied to the fiscal 2026 budget, which is expected to be approved by the Cabinet on Friday. Japan’s primary dealers said this month that more issuance of two-, five- and 10-year government bonds is desirable for next fiscal year starting April 1, while calling for a reduction in sales of super-long debt.

Japan will likely reduce new issuance of super-long government bonds next fiscal year to around 17 trillion yen ($109 billion), the lowest level in 17 years, Reuters reported, citing two unidentified government officials.

Next Story