Small Fin Banks lead Indian banking job creation in FY25

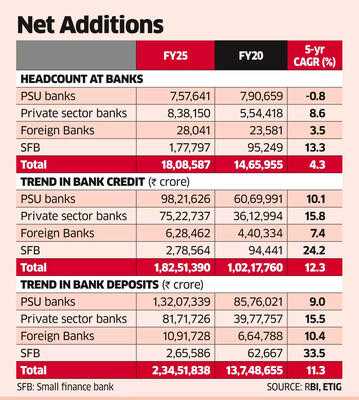

ET Intelligence Group: Small Finance Banks (SFBs) emerged as the biggest job creators in the Indian banking sector with net hiring hitting a five-year high of 26,736 in FY25, according to the latest data from the Reserve Bank of India (RBI). Private sector banks consolidated their hiring, resulting in a contraction in the employee base by 7,257 in FY25 after recruiting 75,000-1,00,000 employees in each of the three years to FY24. This and efforts by SFBs to chase faster business growth helped them become the largest banking recruiters in FY25.

While the size of their operations in terms of the share of credit and deposit at over 1% is miniscule, SFBs have staged a rapid growth over the past five years as they strive to get the universal banking license. Their credit and deposits grew at a compounded annual growth rate (CAGR) of around 25% and 34% respectively between FY20 and FY25 compared with 11-13% annual growth for the total credit and deposits in the banking system.

Industry experts attribute the aggressive hiring at SFBs to their growth ambitions, particularly plans to expand balance sheets and deepen distribution. "The hiring momentum at SFBs is structural rather than cyclical," Sarvjit Singh Samra, MD & CEO, Capital Small Finance Bank told ET. He mentioned that SFBs have come of age after stabilising asset quality, liability profiles and governance frameworks. "These banks are in an active branch and distribution build-out phase, especially across semi-urban and rural markets," Samra added.

Headcount at SFBs jumped to 1.8 lakh in FY25 from 95,249 in FY20, implying a CAGR of 13.3%. The total number of employees in the country's banking system grew by 4.3% annually to 18.1 lakh during the period.

The hiring momentum by SFBs has continued in FY26 as well. Of the 11 SFBs, the eight listed banks have onboarded nearly 9,000 employees in the first six months alone. Several SFBs are positioning themselves for a transition to universal banking, prompting them to scale operations well ahead of regulatory approvals. RBI's recent approval to AU Small Finance Bank to convert into a universal bank highlights this trend. Ujjivan Small Finance Bank applied for a universal bank licence in February last year while Jana Small Finance Bank applied in June. Equitas Small Finance Bank has also expressed interest in seeking universal banking licence.

While the size of their operations in terms of the share of credit and deposit at over 1% is miniscule, SFBs have staged a rapid growth over the past five years as they strive to get the universal banking license. Their credit and deposits grew at a compounded annual growth rate (CAGR) of around 25% and 34% respectively between FY20 and FY25 compared with 11-13% annual growth for the total credit and deposits in the banking system.

Industry experts attribute the aggressive hiring at SFBs to their growth ambitions, particularly plans to expand balance sheets and deepen distribution. "The hiring momentum at SFBs is structural rather than cyclical," Sarvjit Singh Samra, MD & CEO, Capital Small Finance Bank told ET. He mentioned that SFBs have come of age after stabilising asset quality, liability profiles and governance frameworks. "These banks are in an active branch and distribution build-out phase, especially across semi-urban and rural markets," Samra added.

Headcount at SFBs jumped to 1.8 lakh in FY25 from 95,249 in FY20, implying a CAGR of 13.3%. The total number of employees in the country's banking system grew by 4.3% annually to 18.1 lakh during the period.

The hiring momentum by SFBs has continued in FY26 as well. Of the 11 SFBs, the eight listed banks have onboarded nearly 9,000 employees in the first six months alone. Several SFBs are positioning themselves for a transition to universal banking, prompting them to scale operations well ahead of regulatory approvals. RBI's recent approval to AU Small Finance Bank to convert into a universal bank highlights this trend. Ujjivan Small Finance Bank applied for a universal bank licence in February last year while Jana Small Finance Bank applied in June. Equitas Small Finance Bank has also expressed interest in seeking universal banking licence.

Next Story