TPG nears deal to buy 30-40% stake in IIFL Capital

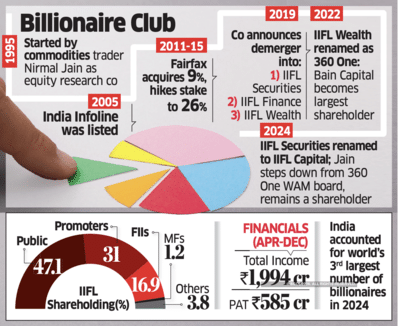

TPG Capital is closing in on a slice of billionaire Nirmal Jain’s flagship listed financial services firm, IIFL Capital Services, potentially emerging as the single largest shareholder in the company, said people aware of the matter. TPG’s interest coincides with Jain’s efforts to transform his brokerage firm and re-enter wealth management to repeat the runaway success of 360 One, which was earlier part of his group.

The US buyout group is currently conducting due diligence with the aim of picking up a significant minority stake of 30-40% and trigger an open offer for an additional 26% stake. The eventual holding will depend on the stock tendered by minority shareholders in the open offer. IIFL Capital closed at ₹389 on the BSE on Tuesday, up 2.5% for a market value of ₹12,119.18 crore.

The promoters, led by Jain and his wife Madhu, own 30.98%, while Prem Watsa-backed Fairfax is the second largest shareholder with a 27.27% stake held via FIH Mauritius Investment. Abu Dhabi Investment Authority is also a backer.

TPG’s investment could be a combination of primary and secondary capital infusion — the final contours will crystallise in the coming weeks.

The IIFL stock has zoomed 26% since December on speculation of a potential investor entering to provide growth equity. At current prices, TPG’s investment could be in the range of ₹3,635.7 crore to ₹4,847.6 crore, excluding the open offer. If fully subscribed, the transaction size could go up to about ₹8,000 crore.

TPG and IIFL Capital didn’t respond to queries.

Wealth Management

Headquartered in Mumbai, IIFL Capital decided to pivot toward becoming a full-service wealth manager in 2024. It changed its name from IIFL Securities to IIFL Capital in the previous fiscal year. It has a national presence through more than 100 branches and 3,500 external wealth partners. Its primary business remains broking and allied activities such as margin trading facility (MTF), depository and retail brokerage that contributed 74% of total income for the first nine months of FY25.

The distribution of financial products was the second-largest business vertical, contributing 16% of income in the same period, followed by investment banking at 10%. It had a market share of 0.67% of the turnover volume (cash and derivatives segments) of the National Stock Exchange for the first half of FY25. During the first nine months of fiscal 2025, total income and PAT were Rs 1,994 crore and Rs 585 crore, respectively.

The management has been keen to focus on asset accumulation and wealth to tap into the growing number of rich clients. After hiring senior leaders from ASK Wealth, the company has added over 100 relationship managers for wealth management in the last 18 months from Citi, Barclays, Axis Bank and Standard Chartered, with an aim to build a franchise with Rs 50,000-crore assets under management.

CNBC TV18 reported in December that PE groups such as TPG and Bain Capital were evaluating the purchase of a 19.99% stake in the company.

India accounted for the world’s third-largest number of billionaires in 2024, reflecting 123% growth since 2015. The combined wealth of Indian billionaires surged by 42.1% in 2025 to $905.6 billion. The company has a pan-India presence with more than 457,000 active clients on September 30, 2024. The margin trading facility gross book was Rs 1,427 crore on December 31, 2024.

Take 2

TPG, like several of its private equity peers, has been scouting for scaled assets in the wealth space and had evaluated Nuvama and an investment in Blackstone-backed ASK Wealth in the recent past.

“An investment at the listed entity makes it easier for an eventual exit and automatically gives an exposure at the whole portfolio,” said one of the persons cited above. “IIFL’s lending business is overcapitalised but Jain wants to prove that he can repeat the success of 360 One, which he was instrumental in founding and growing before it got demerged. Jain has now stepped down from the board of 360 One as well.”

A deep-pocketed partner at this juncture will, therefore, be key for his expansion plans, the person said, adding that TPG also has exposure in competing shadow lenders.

Jain’s businesses include IIFL Capital, shadow bank IIFL Finance, online broker 5Paisa Capital and a small stake in 360 One. Last year, UBS Group AG, the world’s largest wealth manager outside the US, agreed to sell its sub-scale Indian wealth unit to 360 One WAM in return for an option to acquire a minority stake in the domestic firm and a partnership that will see the Swiss bank boost its business in the country.

The US buyout group is currently conducting due diligence with the aim of picking up a significant minority stake of 30-40% and trigger an open offer for an additional 26% stake. The eventual holding will depend on the stock tendered by minority shareholders in the open offer. IIFL Capital closed at ₹389 on the BSE on Tuesday, up 2.5% for a market value of ₹12,119.18 crore.

The promoters, led by Jain and his wife Madhu, own 30.98%, while Prem Watsa-backed Fairfax is the second largest shareholder with a 27.27% stake held via FIH Mauritius Investment. Abu Dhabi Investment Authority is also a backer.

TPG’s investment could be a combination of primary and secondary capital infusion — the final contours will crystallise in the coming weeks.

The IIFL stock has zoomed 26% since December on speculation of a potential investor entering to provide growth equity. At current prices, TPG’s investment could be in the range of ₹3,635.7 crore to ₹4,847.6 crore, excluding the open offer. If fully subscribed, the transaction size could go up to about ₹8,000 crore.

TPG and IIFL Capital didn’t respond to queries.

Wealth Management

Headquartered in Mumbai, IIFL Capital decided to pivot toward becoming a full-service wealth manager in 2024. It changed its name from IIFL Securities to IIFL Capital in the previous fiscal year. It has a national presence through more than 100 branches and 3,500 external wealth partners. Its primary business remains broking and allied activities such as margin trading facility (MTF), depository and retail brokerage that contributed 74% of total income for the first nine months of FY25.

The distribution of financial products was the second-largest business vertical, contributing 16% of income in the same period, followed by investment banking at 10%. It had a market share of 0.67% of the turnover volume (cash and derivatives segments) of the National Stock Exchange for the first half of FY25. During the first nine months of fiscal 2025, total income and PAT were Rs 1,994 crore and Rs 585 crore, respectively.

The management has been keen to focus on asset accumulation and wealth to tap into the growing number of rich clients. After hiring senior leaders from ASK Wealth, the company has added over 100 relationship managers for wealth management in the last 18 months from Citi, Barclays, Axis Bank and Standard Chartered, with an aim to build a franchise with Rs 50,000-crore assets under management.

CNBC TV18 reported in December that PE groups such as TPG and Bain Capital were evaluating the purchase of a 19.99% stake in the company.

India accounted for the world’s third-largest number of billionaires in 2024, reflecting 123% growth since 2015. The combined wealth of Indian billionaires surged by 42.1% in 2025 to $905.6 billion. The company has a pan-India presence with more than 457,000 active clients on September 30, 2024. The margin trading facility gross book was Rs 1,427 crore on December 31, 2024.

Take 2

TPG, like several of its private equity peers, has been scouting for scaled assets in the wealth space and had evaluated Nuvama and an investment in Blackstone-backed ASK Wealth in the recent past.

“An investment at the listed entity makes it easier for an eventual exit and automatically gives an exposure at the whole portfolio,” said one of the persons cited above. “IIFL’s lending business is overcapitalised but Jain wants to prove that he can repeat the success of 360 One, which he was instrumental in founding and growing before it got demerged. Jain has now stepped down from the board of 360 One as well.”

A deep-pocketed partner at this juncture will, therefore, be key for his expansion plans, the person said, adding that TPG also has exposure in competing shadow lenders.

Jain’s businesses include IIFL Capital, shadow bank IIFL Finance, online broker 5Paisa Capital and a small stake in 360 One. Last year, UBS Group AG, the world’s largest wealth manager outside the US, agreed to sell its sub-scale Indian wealth unit to 360 One WAM in return for an option to acquire a minority stake in the domestic firm and a partnership that will see the Swiss bank boost its business in the country.

Next Story