Gold, Silver Prices on February 18: Check Today’s Rates in Your City

Gold and silver prices bounced back in India on February 18, opening higher after slipping for two consecutive sessions. The rebound was seen across futures and spot markets, supported by improved global cues and bargain buying after the recent correction. Both precious metals showed a strong start on the Multi Commodity Exchange (MCX), reflecting renewed investor confidence.

Gold Prices Today

Gold futures for April 2026 delivery gained close to 1 per cent in early trade. The contract rose by around ₹1,430 to trade near ₹1,52,880 per 10 grams, after touching an intraday high of ₹1,53,303. Gold had opened the session at ₹1,52,899 per 10 grams, signaling a positive start right from the opening bell.

Market participants attributed the rise to a recovery in international gold prices and short-covering after the sharp sell-off seen in the previous session.

Silver Prices Outperform

Silver futures for March 2026 delivery outperformed gold, recording a sharper rise of over 2 per cent. Prices surged by ₹4,667 to trade around ₹2,33,450 per kg, while the intraday high stood at ₹2,33,673 per kg. MCX silver opened nearly 2 per cent higher compared to its previous close, indicating strong buying interest.

What Triggered the Recovery?

The uptick in bullion prices comes a day after both gold and silver fell sharply on February 17. The earlier decline was driven by adverse currency movements and weak global market signals, which pressured prices across all purity levels. Wednesday’s rebound suggests that investors are stepping in at lower levels, supported by stabilising global trends.

Silver Prices Across India

As of February 18, silver prices in India are hovering around ₹2,59,900 per kg. Sterling silver, also known as Silver 925, is trading at a premium and is priced at approximately ₹2,89,000 per kg.

In major cities, the rate of Silver 999 stands uniform at ₹2,599 per 10 grams:

Why Silver Moves Differently From Gold

Unlike gold, which is largely driven by investment demand, interest rates, and global economic uncertainty, silver prices are influenced by both investment and industrial demand. Its widespread use in electronics, solar panels, and manufacturing makes silver more sensitive to economic activity, often resulting in higher volatility compared to gold.

Market Outlook

With international markets showing signs of recovery, bullion prices may remain volatile in the near term. Investors and buyers are advised to keep a close watch on global economic data, currency movements, and central bank signals, which are likely to influence gold and silver prices in the days ahead.

Disclaimer: The gold and silver prices mentioned above are indicative and meant for informational purposes only. Rates may vary across cities due to local taxes, duties, and making charges. Prices are subject to change based on market conditions. Readers are advised to consult authorized dealers or financial experts before making any investment or purchase decisions.

Gold Prices Today

Gold futures for April 2026 delivery gained close to 1 per cent in early trade. The contract rose by around ₹1,430 to trade near ₹1,52,880 per 10 grams, after touching an intraday high of ₹1,53,303. Gold had opened the session at ₹1,52,899 per 10 grams, signaling a positive start right from the opening bell. Market participants attributed the rise to a recovery in international gold prices and short-covering after the sharp sell-off seen in the previous session.

Silver Prices Outperform

Silver futures for March 2026 delivery outperformed gold, recording a sharper rise of over 2 per cent. Prices surged by ₹4,667 to trade around ₹2,33,450 per kg, while the intraday high stood at ₹2,33,673 per kg. MCX silver opened nearly 2 per cent higher compared to its previous close, indicating strong buying interest. What Triggered the Recovery?

The uptick in bullion prices comes a day after both gold and silver fell sharply on February 17. The earlier decline was driven by adverse currency movements and weak global market signals, which pressured prices across all purity levels. Wednesday’s rebound suggests that investors are stepping in at lower levels, supported by stabilising global trends.You may also like

- Google announces dates for its next I/O developer conference

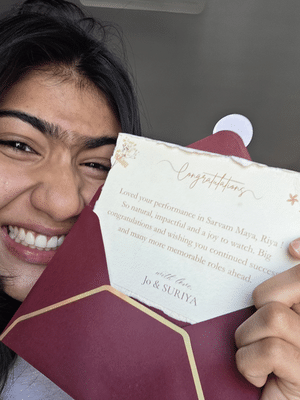

Suriya, Jyothika compliment Riya Shibu for Sarvam Maya; actress says she is 'over the moon'

Suriya, Jyothika compliment Riya Shibu for Sarvam Maya; actress says she is 'over the moon'- ECI announces schedule for biennial Rajya Sabha polls across 10 states

- When Salman Khan said he did nothing in 'Karan Arjun' still received all the credit for its success

India's AI Decade Begins, But Mind The Gap

India's AI Decade Begins, But Mind The Gap

Gold Prices in Major Indian Cities (February 18, per gram)

Gold prices remained steady in the physical markets, with slight variations across cities:- Delhi: 24K – ₹15,434 | 22K – ₹14,149

- Mumbai: 24K – ₹15,419 | 22K – ₹14,134

- Kolkata: 24K – ₹15,419 | 22K – ₹14,134

- Chennai: 24K – ₹15,621 | 22K – ₹14,319

Silver Prices Across India

As of February 18, silver prices in India are hovering around ₹2,59,900 per kg. Sterling silver, also known as Silver 925, is trading at a premium and is priced at approximately ₹2,89,000 per kg. In major cities, the rate of Silver 999 stands uniform at ₹2,599 per 10 grams:

- Delhi: ₹2,59,900 per kg

- Mumbai: ₹2,59,900 per kg

- Kolkata: ₹2,59,900 per kg

- Chennai: ₹2,59,900 per kg

Why Silver Moves Differently From Gold

Unlike gold, which is largely driven by investment demand, interest rates, and global economic uncertainty, silver prices are influenced by both investment and industrial demand. Its widespread use in electronics, solar panels, and manufacturing makes silver more sensitive to economic activity, often resulting in higher volatility compared to gold. Market Outlook

With international markets showing signs of recovery, bullion prices may remain volatile in the near term. Investors and buyers are advised to keep a close watch on global economic data, currency movements, and central bank signals, which are likely to influence gold and silver prices in the days ahead. Disclaimer: The gold and silver prices mentioned above are indicative and meant for informational purposes only. Rates may vary across cities due to local taxes, duties, and making charges. Prices are subject to change based on market conditions. Readers are advised to consult authorized dealers or financial experts before making any investment or purchase decisions.