How to Stay Safe from Digital Fraud in Everyday Online Use

With online banking, digital payments, shopping apps, and social media becoming part of daily life, the risk of digital fraud has increased significantly. Fraudsters often target people during routine online activities, making awareness and caution essential. By adopting smart digital habits, you can protect your personal information, money, and peace of mind.

Be Alert While Sharing Personal Information

Never share sensitive details such as passwords, PINs, OTPs, or card information through calls, messages, or emails. Banks, government bodies, and trusted companies never ask for such information online or over the phone.

Create Strong and Unique Passwords

Use strong passwords that combine letters, numbers, and special characters. Avoid using the same password across multiple platforms. Changing passwords regularly reduces the risk of unauthorized access.

Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra security layer by requiring an additional verification step, such as an OTP or biometric check. Enable 2FA for banking, email, and social media accounts whenever possible.

Identify Phishing Attempts

Be cautious of emails, messages, or links that create urgency or offer unbelievable rewards. Always verify the sender, check website URLs carefully, and avoid clicking unknown links or downloading suspicious attachments.

Keep Your Devices Secure and Updated

Regularly update your phone, computer, and apps to ensure the latest security patches are installed. Use trusted antivirus software and avoid using public Wi-Fi networks for financial transactions.

Monitor Financial Activity Regularly

Check bank statements, transaction alerts, and credit card bills frequently. Immediate reporting of suspicious activity can help prevent major financial losses.

Limit Information Shared on Social Media

Oversharing personal details such as contact numbers, addresses, travel plans, or birthdays can make you vulnerable to targeted scams. Review privacy settings and share cautiously.

Verify Before Making Payments

Double-check payment requests, QR codes, and bank details before transferring money. Be especially cautious of messages or calls demanding immediate action or payment.

Know Where to Report Fraud

If you suspect digital fraud, contact your bank immediately and report the incident to the official cybercrime authorities. Quick reporting increases the chances of recovery and prevents further misuse.

Staying safe from digital fraud doesn’t require technical expertise just awareness and careful habits. By staying informed and cautious during everyday online activities, you can enjoy the benefits of the digital world while keeping your personal and financial information secure.

Be Alert While Sharing Personal Information

Never share sensitive details such as passwords, PINs, OTPs, or card information through calls, messages, or emails. Banks, government bodies, and trusted companies never ask for such information online or over the phone.

Create Strong and Unique Passwords

Use strong passwords that combine letters, numbers, and special characters. Avoid using the same password across multiple platforms. Changing passwords regularly reduces the risk of unauthorized access.

Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra security layer by requiring an additional verification step, such as an OTP or biometric check. Enable 2FA for banking, email, and social media accounts whenever possible.

Identify Phishing Attempts

Be cautious of emails, messages, or links that create urgency or offer unbelievable rewards. Always verify the sender, check website URLs carefully, and avoid clicking unknown links or downloading suspicious attachments.

Keep Your Devices Secure and Updated

Regularly update your phone, computer, and apps to ensure the latest security patches are installed. Use trusted antivirus software and avoid using public Wi-Fi networks for financial transactions.

Monitor Financial Activity Regularly

Check bank statements, transaction alerts, and credit card bills frequently. Immediate reporting of suspicious activity can help prevent major financial losses.

Limit Information Shared on Social Media

You may also like

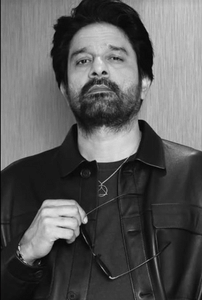

Kareena Kapoor's wish for her Jaane Jaan co-star Jaideep Ahlawat: 'Happy birthday Professor'

Kareena Kapoor's wish for her Jaane Jaan co-star Jaideep Ahlawat: 'Happy birthday Professor' Mysuru: Zebra that gave birth to female calf 2 days ago dies

Mysuru: Zebra that gave birth to female calf 2 days ago dies Man arrested for sexually assaulting minor in Bengal's Narendrapur

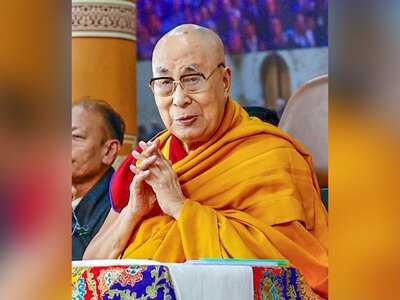

Man arrested for sexually assaulting minor in Bengal's Narendrapur Dalai Lama's office dismisses reports linking Tibetan spiritual leader to Jeffrey Epstein

Dalai Lama's office dismisses reports linking Tibetan spiritual leader to Jeffrey Epstein- T20 World Cup: We were surprised as wickets in Mumbai are generally flat, Axar Patel says

Oversharing personal details such as contact numbers, addresses, travel plans, or birthdays can make you vulnerable to targeted scams. Review privacy settings and share cautiously.

Verify Before Making Payments

Double-check payment requests, QR codes, and bank details before transferring money. Be especially cautious of messages or calls demanding immediate action or payment.

Know Where to Report Fraud

If you suspect digital fraud, contact your bank immediately and report the incident to the official cybercrime authorities. Quick reporting increases the chances of recovery and prevents further misuse.

Staying safe from digital fraud doesn’t require technical expertise just awareness and careful habits. By staying informed and cautious during everyday online activities, you can enjoy the benefits of the digital world while keeping your personal and financial information secure.