Morning Dispatch: Late-stage deals lag in 2025; AngelList CEO interview

Happy Monday! Late-stage startup funding lost steam in 2025 amid a buzzing IPO market. This and more in today’s ETtech Morning Dispatch.

Also in the letter:

■ IT deal wins

■ Groww’s new offering

■ Wakefit IPO

Year in review: Late-stage deals hushed by loud IPO buzz

India’s late-stage startup funding cooled in 2025 as public markets absorbed capital that would otherwise have flowed into large private rounds.

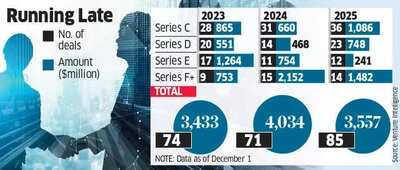

By the numbers: Capital raised through Series C to Series F and later-stage rounds fell to $3.5 billion so far this year, down from $4.03 billion in 2024, according to Venture Intelligence.

Hot IPO market: A busy listing calendar has reshaped capital allocation. Venture-backed firms such as Lenskart, Groww, PhysicsWallah and Ather Energy tapped public markets in 2025, making it one of the most active IPO years since the 2021-22 wave that featured Zomato, Nykaa and Paytm.

Industry executives said robust institutional demand in IPOs diverted liquidity away from late-stage private deals.

Large payouts:

Supply crunch: Late-stage funding has been under pressure even before 2025. Industry executives pointed to a shrinking pool of large cheque writers after Tiger Global, SoftBank, Prosus, and several hedge funds scaled back exposure following the 2021-22 peak.

Also Read: Not rushing our firms to public markets; no pressure to exit: SoftBank's Sumer Juneja

ET in the Valley: AngelList relooks at India strategy as regulatory changes impact angel investing

AngelList CEO Avlok Kohli

AngelList CEO Avlok Kohli

AngelList is reassessing its India strategy as the country rolls out tighter rules for angel investing, chief executive Avlok Kohli told ET in an interview.

Context: AngelList once operated investment syndicates across several markets, but gradually narrowed its focus to the US as regulations elsewhere grew more complex. In India, however, its local arm, AngelList India, continues to operate as an independent entity.

“We still own a majority of AngelList India, though the model there is more decentralised,” Kohli said.

Also Read: Angel investors in India will become rarer than tigers

State of play:

Existing funds have a one-year transition window till September 8, 2026, to comply. Investment thresholds have been reset, with a minimum cheque size of Rs 10 lakh and a maximum of Rs 25 crore per company. Demand revival: IT services firms log 26% jump in Q2 deal wins

Top-tier software firms in India saw a sharp pick up in deal momentum during the July-September quarter, with total contract value (TCV) rising 26% year-on-year, according to a note by Mirae Asset Sharekhan.

Analysts expect the trend to strengthen over the next two years, as enterprise spending on artificial intelligence (AI) gathers pace.

What's happening:

What they're saying: Nuvama noted that IT deal activity has held up over recent quarters, despite tariff-related and geopolitical uncertainty, as reflected in the steady expansion of LTM contract values.

Analysts at Mirae Asset Sharekhan expect demand to stabilise, “barring a significant macro shock”, which would be followed by the resumption of enterprise budget flushes and the release of deferred programs.

Other Top Stories By Our Reporters

Groww adds bonds to offerings: The recently listed wealthtech platform secured the Online Bond Platform Provider (OBPP) licence from markets regulator Sebi, allowing it to offer corporate bonds to retail investors online.

Wakefit anchor book: Mattress and furniture maker Wakefit raised Rs 580 crore from 33 anchor investors, covering around 45% of the Rs 1,288-crore initial public offering set to open today.

New PCB unit in Tamil Nadu: Kochi-based SFO Technologies is looking to set up a printed circuit board (PCB) manufacturing plant in Tamil Nadu’s Theni district with a Rs 2,270 crore investment

Prioritise bias mitigation, stress tests: Govt to IndiaAI Mission beneficiaries | The Centre has cautioned against indigenous foundational AI models that spew historical stereotypes on caste, gender, or regional differences.

Global Picks We Are Reading

■ As key talent abandons Apple, meet the new generation of leaders taking on the old Guard ( Wired)

■ What Google Glass got right — and really, really wrong ( The Verge)

■ Pat Gelsinger wants to save Moore’s Law, with a little help from the Feds ( TechCrunch)

Also in the letter:

■ IT deal wins

■ Groww’s new offering

■ Wakefit IPO

Year in review: Late-stage deals hushed by loud IPO buzz

India’s late-stage startup funding cooled in 2025 as public markets absorbed capital that would otherwise have flowed into large private rounds.

By the numbers: Capital raised through Series C to Series F and later-stage rounds fell to $3.5 billion so far this year, down from $4.03 billion in 2024, according to Venture Intelligence.

Hot IPO market: A busy listing calendar has reshaped capital allocation. Venture-backed firms such as Lenskart, Groww, PhysicsWallah and Ather Energy tapped public markets in 2025, making it one of the most active IPO years since the 2021-22 wave that featured Zomato, Nykaa and Paytm.

Industry executives said robust institutional demand in IPOs diverted liquidity away from late-stage private deals.

Large payouts:

- Listings have created meaningful exits. Around half a dozen technology companies that went public unlocked more than Rs 15,000 crore ($1.6 billion) for shareholders in 2025 via offer for sale (OFS) transactions.

- Promoters and early investors are also sitting on over $8 billion in mark-to-market value on shares they continue to hold.

Supply crunch: Late-stage funding has been under pressure even before 2025. Industry executives pointed to a shrinking pool of large cheque writers after Tiger Global, SoftBank, Prosus, and several hedge funds scaled back exposure following the 2021-22 peak.

Also Read: Not rushing our firms to public markets; no pressure to exit: SoftBank's Sumer Juneja

AngelList is reassessing its India strategy as the country rolls out tighter rules for angel investing, chief executive Avlok Kohli told ET in an interview.

Context: AngelList once operated investment syndicates across several markets, but gradually narrowed its focus to the US as regulations elsewhere grew more complex. In India, however, its local arm, AngelList India, continues to operate as an independent entity.

“We still own a majority of AngelList India, though the model there is more decentralised,” Kohli said.

Also Read: Angel investors in India will become rarer than tigers

State of play:

- Kohli, who joined AngelList in 2019, led its shift from a special-purpose vehicle provider to a software-led platform serving startups and founders.

- AngelList now faces regulatory headwinds in India under Sebi’s revised framework for angel funds and similar platforms.

- The new regime allows angel funds to raise capital only from accredited investors.

Top-tier software firms in India saw a sharp pick up in deal momentum during the July-September quarter, with total contract value (TCV) rising 26% year-on-year, according to a note by Mirae Asset Sharekhan.

Analysts expect the trend to strengthen over the next two years, as enterprise spending on artificial intelligence (AI) gathers pace.

What's happening:

- IT sector deal wins grew 2.8% sequentially in Q2, reversing a 15.2% decline in the previous quarter, BNP Paribas said.

- On a last‑twelve‑months (LTM) basis, aggregate deal wins grew 7.8% in the September 2025 quarter, against a 2.3% in the previous quarter.

- Deal values at Mphasis, Coforge and Wipro underpinned the rise,

- Decline in deal values at Infosys, Atos and Accenture partly offset this growth.

What they're saying: Nuvama noted that IT deal activity has held up over recent quarters, despite tariff-related and geopolitical uncertainty, as reflected in the steady expansion of LTM contract values.

Analysts at Mirae Asset Sharekhan expect demand to stabilise, “barring a significant macro shock”, which would be followed by the resumption of enterprise budget flushes and the release of deferred programs.

Other Top Stories By Our Reporters

Groww adds bonds to offerings: The recently listed wealthtech platform secured the Online Bond Platform Provider (OBPP) licence from markets regulator Sebi, allowing it to offer corporate bonds to retail investors online.

Wakefit anchor book: Mattress and furniture maker Wakefit raised Rs 580 crore from 33 anchor investors, covering around 45% of the Rs 1,288-crore initial public offering set to open today.

New PCB unit in Tamil Nadu: Kochi-based SFO Technologies is looking to set up a printed circuit board (PCB) manufacturing plant in Tamil Nadu’s Theni district with a Rs 2,270 crore investment

Prioritise bias mitigation, stress tests: Govt to IndiaAI Mission beneficiaries | The Centre has cautioned against indigenous foundational AI models that spew historical stereotypes on caste, gender, or regional differences.

Global Picks We Are Reading

■ As key talent abandons Apple, meet the new generation of leaders taking on the old Guard ( Wired)

■ What Google Glass got right — and really, really wrong ( The Verge)

■ Pat Gelsinger wants to save Moore’s Law, with a little help from the Feds ( TechCrunch)

Next Story