Top 5 tech and startup stories of the day

Nykaa posts strong Q3 results as profits and revenue surge. This and more in today's ETtech Top 5.

Also in the letter:

■ The AI cola wars

■ Govt's GPU push

■ Amit Agarwal's expanded role

Nykaa reports 2.5x rise in Q3 net profit to Rs 68 crore, revenue jumps 27%

Falguni Nayar, founder and CEO, Nykaa

Falguni Nayar, founder and CEO, Nykaa

Nykaa parent FSN E-Commerce Ventures reported robust growth in the December quarter of FY26, with profits more than doubling and revenue increasing significantly compared to the previous year.

Financials:

Also Read: Nykaa eyes Rs 6,000 crore GMV from in-house brands by FY30, ramps up fashion and AI bets

CEOSpeak: Founder and CEO Falguni Nayar said Q3 was Nykaa’s best-ever quarter, with record GMV and Ebitda margin, while keeping the company on track for long-term growth.

“This performance reflects steady execution against our strategic priorities, as we continue to invest in assortment expansion, offline growth, and technology-led discovery, alongside a disciplined focus on efficiency,” Nayar said.

Also Read: Quick commerce is not creating new demand: Nykaa Beauty CEO Anchit Nayar Google parent Alphabet says capital spending in 2026 could double, cloud business booms

Sundar Pichai, CEO, Alphabet

Sundar Pichai, CEO, Alphabet

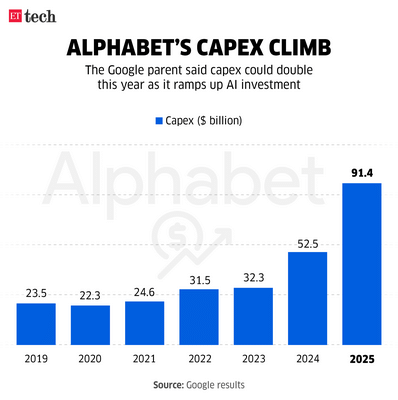

Alphabet is preparing to sharply raise capital spending in 2026 as Big Tech leans deeper into the AI arms race.

What's happening? Alphabet said it could double capital expenditure this year to expand AI and compute capacity, joining rivals that are committing unprecedented sums to infrastructure.

Yes, but? The scale of spending has unsettled markets, with concerns around payback periods and margin pressure. Even so, Google has managed to reassure investors so far. Its stock is up since early 2025, helped by improving cloud growth and clearer AI traction.

Google's redemption: The launch of Google’s Gemini 3 in November changed the narrative around Google’s AI position. The model helped erase the perception that the company was an AI laggard, and prompted rivals to move faster. OpenAI, according to reports, issued an internal "code red" to speed up development.

Snap reports upbeat revenue as holiday season fuels ad sales

Snap posted a stronger-than-expected December quarter as more advertisers spent more during the holiday season.

Financials:

Sam Altman, CEO, OpenAI and Dario Amodei, CEO, Anthropic

Sam Altman, CEO, OpenAI and Dario Amodei, CEO, Anthropic

Sam Altman didn't miss the subtext. The OpenAI chief took aim at rival Anthropic’s Super Bowl ad campaign, calling it “clearly dishonest”, while conceding that yes, it was also “funny.”

What's the matter? Anthropic rolled out a national ad showing a generic AI chatbot barging into conversations with awkward product pitches, before landing its punchline: “Ads are coming to AI. But not to Claude.” The message was hard to miss.

While OpenAI or ChatGPT were never named, the swipe came soon after ChatGPT began testing ads in its free tiers.

Altman argued the ad caricatured a future that OpenAI does not intend to build, and accused Anthropic of attacking a straw man to score points.

Also Read: Here is why Anthropic claims to keep Claude ad-free forever

Altman's accusations:

Altman emphasised OpenAI’s support for “broad, democratic decision making” in AI, adding: “This time belongs to the builders, not the people who want to control them.”

Also Read: Fear factor: Claude Cowork, techies no work?

Govt eyeing 25,000 more GPUs as AI Mission's fourth tender closes

The government is gearing up to expand its sovereign AI infrastructure by adding nearly 25,000 graphics processing units (GPUs) in the coming weeks.

Driving the news: This fresh batch, under the fourth round of the IndiaAI Mission, will add to existing commitments of over 40,535 GPUs. The aim is to subsidise compute costs for startups and researchers to under $1 per hour, the lowest rate globally, senior government officials told us.

The hardware push: Technical bid evaluations are underway. Four empanelled cloud service providers — Yotta Data Services, E2E Networks, NxtGen Datacenter, and Cyfuture India — have confirmed their participation. Bids include Nvidia's B200 and the highly sought-after B300 liquid-cooled GPUs.

Tell me more:

Also Read: Economic Survey notes rising AI compute costs amid surging global GPU demand

Amazon expands SVP Amit Agarwal's role to include global selling partner services

Amit Agarwal, SVP, Amazon

Amit Agarwal, SVP, Amazon

Amazon has expanded the remit of Amit Agarwal, senior vice president for emerging markets, to include global selling partner services (SPS) among his responsibilities.

What's changed? Agarwal, a 27-year Amazon veteran, will now oversee the teams that support and monetise Amazon’s sprawling worldwide network of third-party sellers. The company’s global SPS vertical supports and monetises Amazon's large third-party seller ecosystem.

Top-level rejig: The reshuffle follows Dharmesh Mehta’s transition from vice-president of Worldwide SPS to a technical advisor role directly reporting to CEO Andy Jassy. Agarwal, based in Seattle, will report to Doug Herrington, CEO of Worldwide Amazon Stores.

Alongside the expanded global brief, Agrawal will continue to lead Amazon’s international operations across 10 key markets, including India.

Yes, and: “What the selling partner services team has accomplished is truly impressive — enabling our selling partners to deliver a delightful and trustworthy customer experience, and building a thriving global community of millions of sellers,” Agarwal said in a social media post.

Also Read: ETtech Interview: We’re not late to quick commerce; seeing a big uptick among Prime members: Amit Agarwal

Also in the letter:

■ The AI cola wars

■ Govt's GPU push

■ Amit Agarwal's expanded role

Nykaa reports 2.5x rise in Q3 net profit to Rs 68 crore, revenue jumps 27%

Nykaa parent FSN E-Commerce Ventures reported robust growth in the December quarter of FY26, with profits more than doubling and revenue increasing significantly compared to the previous year.

Financials:

- Net profit: Jumped 151 % to Rs 67.7 crore, from Rs 26.9 crore a year earlier

- Revenue from operations: Rose 27% to Rs 2,873 crore, from Rs 2,267 crore

- Gross merchandise value (GMV): Increased 28% year-on-year (YoY) to Rs 5,795 crore

- Earnings before interest, taxes, depreciation and amortisation (Ebitda): Increased 63% YoY to Rs 230 crore

Also Read: Nykaa eyes Rs 6,000 crore GMV from in-house brands by FY30, ramps up fashion and AI bets

CEOSpeak: Founder and CEO Falguni Nayar said Q3 was Nykaa’s best-ever quarter, with record GMV and Ebitda margin, while keeping the company on track for long-term growth.

“This performance reflects steady execution against our strategic priorities, as we continue to invest in assortment expansion, offline growth, and technology-led discovery, alongside a disciplined focus on efficiency,” Nayar said.

Also Read: Quick commerce is not creating new demand: Nykaa Beauty CEO Anchit Nayar Google parent Alphabet says capital spending in 2026 could double, cloud business booms

Alphabet is preparing to sharply raise capital spending in 2026 as Big Tech leans deeper into the AI arms race.

What's happening? Alphabet said it could double capital expenditure this year to expand AI and compute capacity, joining rivals that are committing unprecedented sums to infrastructure.

- Meta plans to lift AI investment by about 73% in 2026.

- Microsoft reported record quarterly spending tied to AI and data centres.

- Cloud and AI workloads are the biggest drivers of new capacity.

Yes, but? The scale of spending has unsettled markets, with concerns around payback periods and margin pressure. Even so, Google has managed to reassure investors so far. Its stock is up since early 2025, helped by improving cloud growth and clearer AI traction.

Google's redemption: The launch of Google’s Gemini 3 in November changed the narrative around Google’s AI position. The model helped erase the perception that the company was an AI laggard, and prompted rivals to move faster. OpenAI, according to reports, issued an internal "code red" to speed up development.

Snap reports upbeat revenue as holiday season fuels ad sales

Snap posted a stronger-than-expected December quarter as more advertisers spent more during the holiday season.

Financials:

- Active advertisers: Up 28% in Q4, with growth in new ad formats such as Sponsored Snaps and Promoted Places

- Revenue: Up 10% to $1.72 billion, beating analysts’ $1.70 billion estimate

- Net income: Rose to $45 million from $9 million a year earlier

- 2025 net loss: Narrowed to $460 million from $698 million in 2024

Sam Altman didn't miss the subtext. The OpenAI chief took aim at rival Anthropic’s Super Bowl ad campaign, calling it “clearly dishonest”, while conceding that yes, it was also “funny.”

What's the matter? Anthropic rolled out a national ad showing a generic AI chatbot barging into conversations with awkward product pitches, before landing its punchline: “Ads are coming to AI. But not to Claude.” The message was hard to miss.

While OpenAI or ChatGPT were never named, the swipe came soon after ChatGPT began testing ads in its free tiers.

Altman argued the ad caricatured a future that OpenAI does not intend to build, and accused Anthropic of attacking a straw man to score points.

Also Read: Here is why Anthropic claims to keep Claude ad-free forever

Altman's accusations:

- He accused Anthropic of “doublespeak” by criticising imaginary practices.

- Altman pointed to scale, claiming more Texans use ChatGPT for free than the total number of people using Claude across the US.

- He noted that ChatGPT Plus and Pro users see no ads, in contrast to Anthropic’s “expensive product to rich people.”

- He criticised Anthropic for attempting to control user actions and limit competitor access to coding tools.

Altman emphasised OpenAI’s support for “broad, democratic decision making” in AI, adding: “This time belongs to the builders, not the people who want to control them.”

Also Read: Fear factor: Claude Cowork, techies no work?

Govt eyeing 25,000 more GPUs as AI Mission's fourth tender closes

The government is gearing up to expand its sovereign AI infrastructure by adding nearly 25,000 graphics processing units (GPUs) in the coming weeks.

Driving the news: This fresh batch, under the fourth round of the IndiaAI Mission, will add to existing commitments of over 40,535 GPUs. The aim is to subsidise compute costs for startups and researchers to under $1 per hour, the lowest rate globally, senior government officials told us.

The hardware push: Technical bid evaluations are underway. Four empanelled cloud service providers — Yotta Data Services, E2E Networks, NxtGen Datacenter, and Cyfuture India — have confirmed their participation. Bids include Nvidia's B200 and the highly sought-after B300 liquid-cooled GPUs.

Tell me more:

- E2E Networks is commissioning India’s first B200 mega cluster with Nvidia Blackwell GPUs.

- Rajagopal AS, chief executive of NxtGen Datacenter & Cloud Technologies, confirmed the commitment to deploy 4,094 B200 GPUs.

Also Read: Economic Survey notes rising AI compute costs amid surging global GPU demand

Amazon has expanded the remit of Amit Agarwal, senior vice president for emerging markets, to include global selling partner services (SPS) among his responsibilities.

What's changed? Agarwal, a 27-year Amazon veteran, will now oversee the teams that support and monetise Amazon’s sprawling worldwide network of third-party sellers. The company’s global SPS vertical supports and monetises Amazon's large third-party seller ecosystem.

Top-level rejig: The reshuffle follows Dharmesh Mehta’s transition from vice-president of Worldwide SPS to a technical advisor role directly reporting to CEO Andy Jassy. Agarwal, based in Seattle, will report to Doug Herrington, CEO of Worldwide Amazon Stores.

Alongside the expanded global brief, Agrawal will continue to lead Amazon’s international operations across 10 key markets, including India.

Yes, and: “What the selling partner services team has accomplished is truly impressive — enabling our selling partners to deliver a delightful and trustworthy customer experience, and building a thriving global community of millions of sellers,” Agarwal said in a social media post.

Also Read: ETtech Interview: We’re not late to quick commerce; seeing a big uptick among Prime members: Amit Agarwal

Next Story