Coming clean may be less taxing: Taxpayers could get away with paying significantly less on unexplained local income

Mumbai: A hidden, quasi-amnesty window for tax on local income has crept into the fine print of the Finance Bill, perhaps unwittingly.

A close reading of the budget documents shows that a person can slip away by proactively paying a significantly lower amount on unexplained domestic income - earnings whose 'sources' a taxpayer cannot spell out.

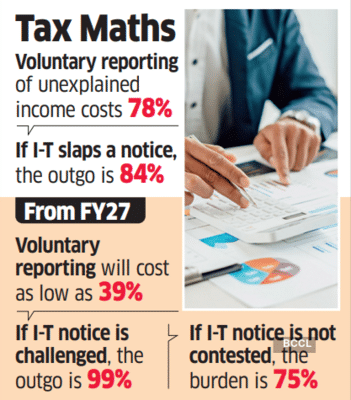

Today, a person has to shell out as much as 78% once he chooses to declare the undisclosed local income in the income tax return (ITR). This comprises a 60% basic tax rate, a surcharge of 25% on the basic rate, and 4% education cess (on the tax and surcharge). Once the bill is passed, the outgo against unexplained income from financial year 2026-27 would shrink to 39% from 78%. How?

While the one-time mini-amnesty for unreported small-valued foreign assets and income appears upfront in the budget, the relief on local unexplained earnings emerges from different clauses in the bill. It's an outcome of changes in the tax rate, penalty, and the conditions where these would apply.

Voluntary Disclosures

Voluntary Disclosures

The budget has proposed a cut in the basic rate (on unexplained income) from 60% to 30% but raised the penalty to 200% from 10% in two situations.

First, when an individual, pulled up for escaping tax on unexplained income, challenges the I-T department, he would have to bear a burden as high as 99%—a 30% tax, 25% surcharge, 4% cess, and 200% penalty (on 30%). Second, a person who chooses not to contest the decision in the appellate bodies and courts, would be spared from the 200% penalty but must pay an ‘additional tax’ of 120%. Here, the outgo adds up to 75%, as against 84% he has to cough up now. (The 84% rate includes 78% for voluntary declaration and the current penalty of 10% on 60%).

Interestingly, however, an assessee can avoid even the lower rate of 75%, and get away by paying just 39% tax if he voluntarily reports the income before the department gets a whiff of it and acts.

According to senior chartered accountant Pradip N Kapasi, a taxpayer may explore afresh the right to voluntarily include the undisclosed income of the specified kinds while filing the return of income for the Tax Year 2026-27 onwards by paying taxes at 39% thereon before the year-end u/s 195 of the IT Act. “Due to the proposed amendments, the tax otherwise payable is 78% of such income. However, such a position should be taken by only those who are not searched and are absolutely sure that the undisclosed amount is not categorised in any way as ‘proceeds of crime’ (POC) or benami property, and the income pertains to the tax year for which return is filed,” he said.

Thus, someone regularising unexplained income by paying 39% must remember that a POC tag could trigger invocation of harsh laws and enforcement actions taken to curb money laundering, benami deals, and black money.

NUDGE TO COME CLEAN?

“The proposed change may be designed to nudge taxpayers to either voluntarily offer such unexplained amounts, in which case no penalty would arise and the effective tax incidence will remain at 39%. Or, to opt for payment of an additional tax of 120% to bring the matter to closure once such income is detected by the assessing officer during assessment proceedings,” said Harshal Bhuta, partner at the CA firm P R Bhuta & Co.

The existing provisions permitting voluntary declaration of income relating to unexplained credits, investments, assets, expenditure, and amounts borrowed or repaid through hundis found few takers due to the high tax of 78%, said Ashish Karundia, founder of the CA firm Ashish Karundia & Co. Consequently, the task of spotting such income was left to tax officials, leading to prolonged assessments and multiple litigations. “While the budget proposal aims to encourage voluntary disclosure of unexplained income by levying tax at 39% with no penalty and granting immunity from prosecution (thereby facilitating early closure and reducing litigation and administrative burden), the relief is confined to the I-T law. Such disclosures may still have consequences under other legislations, including GST, depending on the nature and source of the income,” said Karundia.

A close reading of the budget documents shows that a person can slip away by proactively paying a significantly lower amount on unexplained domestic income - earnings whose 'sources' a taxpayer cannot spell out.

Today, a person has to shell out as much as 78% once he chooses to declare the undisclosed local income in the income tax return (ITR). This comprises a 60% basic tax rate, a surcharge of 25% on the basic rate, and 4% education cess (on the tax and surcharge). Once the bill is passed, the outgo against unexplained income from financial year 2026-27 would shrink to 39% from 78%. How?

While the one-time mini-amnesty for unreported small-valued foreign assets and income appears upfront in the budget, the relief on local unexplained earnings emerges from different clauses in the bill. It's an outcome of changes in the tax rate, penalty, and the conditions where these would apply.

The budget has proposed a cut in the basic rate (on unexplained income) from 60% to 30% but raised the penalty to 200% from 10% in two situations.

First, when an individual, pulled up for escaping tax on unexplained income, challenges the I-T department, he would have to bear a burden as high as 99%—a 30% tax, 25% surcharge, 4% cess, and 200% penalty (on 30%). Second, a person who chooses not to contest the decision in the appellate bodies and courts, would be spared from the 200% penalty but must pay an ‘additional tax’ of 120%. Here, the outgo adds up to 75%, as against 84% he has to cough up now. (The 84% rate includes 78% for voluntary declaration and the current penalty of 10% on 60%).

Interestingly, however, an assessee can avoid even the lower rate of 75%, and get away by paying just 39% tax if he voluntarily reports the income before the department gets a whiff of it and acts.

According to senior chartered accountant Pradip N Kapasi, a taxpayer may explore afresh the right to voluntarily include the undisclosed income of the specified kinds while filing the return of income for the Tax Year 2026-27 onwards by paying taxes at 39% thereon before the year-end u/s 195 of the IT Act. “Due to the proposed amendments, the tax otherwise payable is 78% of such income. However, such a position should be taken by only those who are not searched and are absolutely sure that the undisclosed amount is not categorised in any way as ‘proceeds of crime’ (POC) or benami property, and the income pertains to the tax year for which return is filed,” he said.

Thus, someone regularising unexplained income by paying 39% must remember that a POC tag could trigger invocation of harsh laws and enforcement actions taken to curb money laundering, benami deals, and black money.

NUDGE TO COME CLEAN?

“The proposed change may be designed to nudge taxpayers to either voluntarily offer such unexplained amounts, in which case no penalty would arise and the effective tax incidence will remain at 39%. Or, to opt for payment of an additional tax of 120% to bring the matter to closure once such income is detected by the assessing officer during assessment proceedings,” said Harshal Bhuta, partner at the CA firm P R Bhuta & Co.

The existing provisions permitting voluntary declaration of income relating to unexplained credits, investments, assets, expenditure, and amounts borrowed or repaid through hundis found few takers due to the high tax of 78%, said Ashish Karundia, founder of the CA firm Ashish Karundia & Co. Consequently, the task of spotting such income was left to tax officials, leading to prolonged assessments and multiple litigations. “While the budget proposal aims to encourage voluntary disclosure of unexplained income by levying tax at 39% with no penalty and granting immunity from prosecution (thereby facilitating early closure and reducing litigation and administrative burden), the relief is confined to the I-T law. Such disclosures may still have consequences under other legislations, including GST, depending on the nature and source of the income,” said Karundia.

Next Story