Indians say no to sweet talk: Carbonated, caffeinated or squeezed — more & more people prefer low- or no-sugar drinks

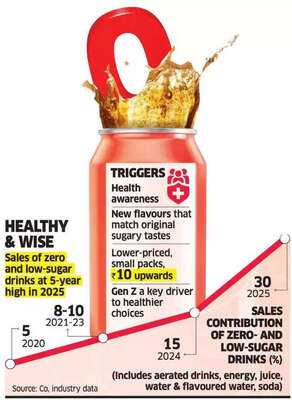

Sales of zero and low-sugar drinks surged to a five-year high in 2025, establishing the emergence of a key market segment out of what used to be dismissed as an urban fad.

Coca-Cola’s volume sales of zero-sugar drinks — including Diet Coke, Coke Zero, no-sugar Thums Up X Force, Sprite Zero and Kinley water, as well as juice and energy drinks — touched an all-time high of 30% of the total in 2025, according to figures available with ET. Diet Coke, which leads the zero-sugar segment, alone saw sales double from the year before.

Coca-Cola leads the Rs 60,000 crore-plus soft drinks market. Rival PepsiCo’s sales of no-sugar and mid-sugar drinks rose to 59% of total volume in the October December 2025, up from 53% in the corresponding year-ago quarter, bottling partner Varun Beverages (VBL) said in its third quarter earnings. This is PepsiCo’s single biggest year-on-year surge. Brands in this omnibus category include energy drink Sting, Pepsi Black, 7 Up Zero Sugar, Tropicana no-sugar variants, Evervess Soda and Aquafina water.

“This reflects our continuous focus on healthier beverage offerings,” said Raj Gandhi, president and whole-time director, Varun Beverages, on the call. VBL is PepsiCo’s second-largest franchise partner outside the US.

“This reflects our continuous focus on healthier beverage offerings,” said Raj Gandhi, president and whole-time director, Varun Beverages, on the call. VBL is PepsiCo’s second-largest franchise partner outside the US.

The trend is spilling from sparkling drinks and juices to coffee and smoothies. Companies attribute this to several reasons including greater health consciousness, Gen Z and even New Year resolutions.

“The shift is particularly visible at the start of the year,” according to Tata Starbucks.

Health Matters

Tata Starbucks believes “resolutions and reset are taking precedence and people reassess everyday choices and routines.” It has introduced sugar-free flavours in more than 500 Starbucks stores in January.

The sales share of zero and low-sugar drinks overall surged to an average 30% in 2025 from about 5% in 2020, with a spike over the past 12 months amid rapidly changing consumer preferences and low-price points, executives said, citing internal and industry data.

“Diets and zeros are acquired tastes and lifestyle products... as opposed to fully loaded sugary drinks,” said a top executive at one of the country’s largest consumer companies. “Indians who were ‘talking health’ but not ‘walking health’ till even five years back, are now paying closer attention to ingredients and calorie intake without letting go of flavour and indulgence—what’s happening now is a clear reversal.”

Coca-Cola is aggressively pushing cans of sugar-free brands such as Thums Up X Force, Coke Zero, Diet Coke and Sprite Zero at Rs 10 upwards. It’s also introducing Schweppes flavoured water in no-sugar variants. Apart from that, social media campaigns that depict the blending of Diet Coke with espresso coffee mixes have caught the attention of customers.

“As consumer preferences evolve, we are further strengthening our low-sugar offerings through innovation, including the launch of Powerade during the ICC World Cup,” a Coca-Cola spokesperson said. The spokesperson declined to comment on the data, citing confidentiality. Coca-Cola had a 71% share of the total diets and lights category in FY25, executives said, citing internal data. These include Diet Coke, Coke Zero as well as the no-sugar variants of Thums Up and Sprite.

“The Indian urban consuming class has hit a generational inflection point for wellness trends, with compulsion and choice accelerating this trend,” said Srinivas Murthy, marketing consultant and angel investor, who’s held marketing chief roles at Coca-Cola India and GSK Consumer Healthcare. “In addition, Gen Z is choosing healthier lifestyles both for health and aesthetic motives, which is reflecting in volume trends thanks to India's youth bulge demographic.”

Coca-Cola’s volume sales of zero-sugar drinks — including Diet Coke, Coke Zero, no-sugar Thums Up X Force, Sprite Zero and Kinley water, as well as juice and energy drinks — touched an all-time high of 30% of the total in 2025, according to figures available with ET. Diet Coke, which leads the zero-sugar segment, alone saw sales double from the year before.

Coca-Cola leads the Rs 60,000 crore-plus soft drinks market. Rival PepsiCo’s sales of no-sugar and mid-sugar drinks rose to 59% of total volume in the October December 2025, up from 53% in the corresponding year-ago quarter, bottling partner Varun Beverages (VBL) said in its third quarter earnings. This is PepsiCo’s single biggest year-on-year surge. Brands in this omnibus category include energy drink Sting, Pepsi Black, 7 Up Zero Sugar, Tropicana no-sugar variants, Evervess Soda and Aquafina water.

The trend is spilling from sparkling drinks and juices to coffee and smoothies. Companies attribute this to several reasons including greater health consciousness, Gen Z and even New Year resolutions.

“The shift is particularly visible at the start of the year,” according to Tata Starbucks.

Health Matters

Tata Starbucks believes “resolutions and reset are taking precedence and people reassess everyday choices and routines.” It has introduced sugar-free flavours in more than 500 Starbucks stores in January.

The sales share of zero and low-sugar drinks overall surged to an average 30% in 2025 from about 5% in 2020, with a spike over the past 12 months amid rapidly changing consumer preferences and low-price points, executives said, citing internal and industry data.

“Diets and zeros are acquired tastes and lifestyle products... as opposed to fully loaded sugary drinks,” said a top executive at one of the country’s largest consumer companies. “Indians who were ‘talking health’ but not ‘walking health’ till even five years back, are now paying closer attention to ingredients and calorie intake without letting go of flavour and indulgence—what’s happening now is a clear reversal.”

Coca-Cola is aggressively pushing cans of sugar-free brands such as Thums Up X Force, Coke Zero, Diet Coke and Sprite Zero at Rs 10 upwards. It’s also introducing Schweppes flavoured water in no-sugar variants. Apart from that, social media campaigns that depict the blending of Diet Coke with espresso coffee mixes have caught the attention of customers.

“As consumer preferences evolve, we are further strengthening our low-sugar offerings through innovation, including the launch of Powerade during the ICC World Cup,” a Coca-Cola spokesperson said. The spokesperson declined to comment on the data, citing confidentiality. Coca-Cola had a 71% share of the total diets and lights category in FY25, executives said, citing internal data. These include Diet Coke, Coke Zero as well as the no-sugar variants of Thums Up and Sprite.

“The Indian urban consuming class has hit a generational inflection point for wellness trends, with compulsion and choice accelerating this trend,” said Srinivas Murthy, marketing consultant and angel investor, who’s held marketing chief roles at Coca-Cola India and GSK Consumer Healthcare. “In addition, Gen Z is choosing healthier lifestyles both for health and aesthetic motives, which is reflecting in volume trends thanks to India's youth bulge demographic.”

Next Story