Insurance premiums rose in 2025, so did costs

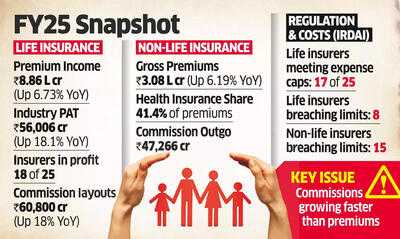

Mumbai: The insurance industry posted steady premium growth in FY25 even as rising distribution costs and breaches of regulatory expense limits caused concerns, according to the Insurance Regulatory and Development Authority of India's (Irdai) latest annual report.

Despite cost pressures, profitability improved in the life insurance sector.

Eighteen of the 25 life insurers reported profits during the year. Industry-wide profit after tax rose 18.14% to ₹56,006 crore, up from ₹47,407 crore in FY24.

Life Insurance Corporation of India saw an 18.38% increase in profits, while private life insurers collectively posted profit growth of 16.69%.

Total life insurance premium income increased 6.73% to ₹8.86 lakh crore, supported by the issuance of 270.22 lakh new individual policies.

Expense management remained under scrutiny across both life and non-life segments.

Under the Irdai (Expenses of Management, including Commission, of Insurers) Regulations, 2024, insurers are required to operate within expense caps linked to product structure, premium-paying term and duration of business. In the life segment, only 17 of the 25 insurers complied with these limits during FY25.

Eight insurers exceeded the prescribed thresholds on an overall basis across participating, non-participating and linked products. Similarly, in general insurance, 15 non-life insurers breached the expenses of management limits and have sought regulatory forbearance, which regulator said is under examination.

Commission costs continued to absorb a large share of industry outgo. Gross commission expenses for the non-life insurance sector stood at ₹47,266 crore in FY25. Private general insurers accounted for ₹30,498 crore of this total, followed by public sector insurers at ₹9,335 crore and standalone health insurers at ₹7,365 crore.

Operating costs moderated slightly in aggregate, but commission payouts were high relative to premium growth.

In life insurance, gross expenses of management reached ₹1.38 lakh crore in FY25, equivalent to 15.6% of total gross premium. Commission payouts rose 18% to ₹60,800 crore, growing faster than premium growth of 6.73% as insurers continued to rely on commission-led distribution, even as regulators tighten oversight on cost structures.

The non-life insurance industry also reported moderate growth, aided primarily by health and motor insurance. Gross direct premium underwritten rose 6.19% to ₹3.08 lakh crore in FY25. Health insurance remained the largest segment, contributing 41.42% of total non-life premium, up from 40.29% a year earlier, though growth slowed sharply to 9.19% from 19.5%. Motor insurance premiums increased 7.97% to ₹99,093 crore, lifting the segment's share to 32.21%, while fire insurance premiums declined 5.58%.

Despite cost pressures, profitability improved in the life insurance sector.

Eighteen of the 25 life insurers reported profits during the year. Industry-wide profit after tax rose 18.14% to ₹56,006 crore, up from ₹47,407 crore in FY24.

Life Insurance Corporation of India saw an 18.38% increase in profits, while private life insurers collectively posted profit growth of 16.69%.

Total life insurance premium income increased 6.73% to ₹8.86 lakh crore, supported by the issuance of 270.22 lakh new individual policies.

Expense management remained under scrutiny across both life and non-life segments.

Under the Irdai (Expenses of Management, including Commission, of Insurers) Regulations, 2024, insurers are required to operate within expense caps linked to product structure, premium-paying term and duration of business. In the life segment, only 17 of the 25 insurers complied with these limits during FY25.

Eight insurers exceeded the prescribed thresholds on an overall basis across participating, non-participating and linked products. Similarly, in general insurance, 15 non-life insurers breached the expenses of management limits and have sought regulatory forbearance, which regulator said is under examination.

Commission costs continued to absorb a large share of industry outgo. Gross commission expenses for the non-life insurance sector stood at ₹47,266 crore in FY25. Private general insurers accounted for ₹30,498 crore of this total, followed by public sector insurers at ₹9,335 crore and standalone health insurers at ₹7,365 crore.

Operating costs moderated slightly in aggregate, but commission payouts were high relative to premium growth.

In life insurance, gross expenses of management reached ₹1.38 lakh crore in FY25, equivalent to 15.6% of total gross premium. Commission payouts rose 18% to ₹60,800 crore, growing faster than premium growth of 6.73% as insurers continued to rely on commission-led distribution, even as regulators tighten oversight on cost structures.

The non-life insurance industry also reported moderate growth, aided primarily by health and motor insurance. Gross direct premium underwritten rose 6.19% to ₹3.08 lakh crore in FY25. Health insurance remained the largest segment, contributing 41.42% of total non-life premium, up from 40.29% a year earlier, though growth slowed sharply to 9.19% from 19.5%. Motor insurance premiums increased 7.97% to ₹99,093 crore, lifting the segment's share to 32.21%, while fire insurance premiums declined 5.58%.

Next Story