Premium motorcycles gain speed as consumer sentiment shifts gears

Consumer preference is shifting towards higher-powered, premium motorcycles, driving a sharp rise in sales as improving affordability and evolving aspirations reshape the market mix.

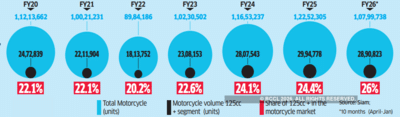

The share of bikes with 125cc engines and above, typically having a starting price of `80,000, has surged to 26% in the first 10 months of FY26 from 22.1% in FY20—the highest in more than five years, according to Society of Indian Automobile Manufacturers (Siam) data compiled by ET.

Rising consumer aspirations and increased affordability after product price cuts following a reduction in goods and services tax (GST) from last September has been fuelling demand for such models. For the fiscal year ended FY25, the segment accounted for 24.4% of total motorcycle sales.

“Motorcycles have seen strong recovery following GST rationalisation,” Crisil said in a release on Tuesday. “While entry-level models up to 125cc continue to dominate, with a share of ~73%, demand is gradually shifting towards the 150-350cc range. The share of these higher capacity models has risen from ~23% in fiscal 2025 to ~25% this fiscal, reflecting improving affordability and ongoing premiumisation. Beyond this, the premium segment remains a small part of the overall mix.”

Among manufacturers, Royal Enfield and TVS Motor have emerged as the biggest beneficiaries of this premiumisation trend. Royal Enfield — maker of the popular Bullet and Hunter models — saw its market share in the 125cc+ segment rise to 32% in the first nine months of FY26, from 27% in FY20. TVS Motor’s share rose to 19% from 15% in the same period, according to a Jefferies Research report. These gains came largely at the expense of Bajaj Auto with its share falling to 22% from 32%.

The share of bikes with 125cc engines and above, typically having a starting price of `80,000, has surged to 26% in the first 10 months of FY26 from 22.1% in FY20—the highest in more than five years, according to Society of Indian Automobile Manufacturers (Siam) data compiled by ET.

Rising consumer aspirations and increased affordability after product price cuts following a reduction in goods and services tax (GST) from last September has been fuelling demand for such models. For the fiscal year ended FY25, the segment accounted for 24.4% of total motorcycle sales.

“Motorcycles have seen strong recovery following GST rationalisation,” Crisil said in a release on Tuesday. “While entry-level models up to 125cc continue to dominate, with a share of ~73%, demand is gradually shifting towards the 150-350cc range. The share of these higher capacity models has risen from ~23% in fiscal 2025 to ~25% this fiscal, reflecting improving affordability and ongoing premiumisation. Beyond this, the premium segment remains a small part of the overall mix.”

Among manufacturers, Royal Enfield and TVS Motor have emerged as the biggest beneficiaries of this premiumisation trend. Royal Enfield — maker of the popular Bullet and Hunter models — saw its market share in the 125cc+ segment rise to 32% in the first nine months of FY26, from 27% in FY20. TVS Motor’s share rose to 19% from 15% in the same period, according to a Jefferies Research report. These gains came largely at the expense of Bajaj Auto with its share falling to 22% from 32%.

Next Story