A decade of Growwth: From mutual fund seller to stock market tsar

Fintech startup Groww will become the first new generation wealthtech company in India to list on the bourses when trading begins on Wednesday.

While startups have been queuing up to join the public markets, Bengaluru-based Groww, founded in 2016, will be one of the youngest Indian fintech ventures to go public, joining the ranks of PB Fintech, Paytm and Mobikwik.

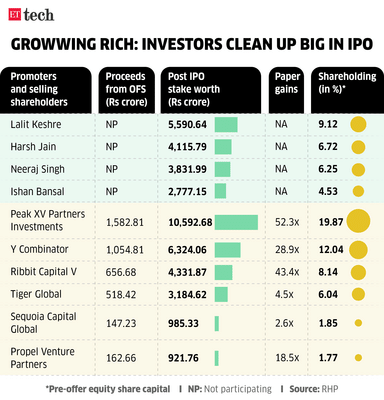

The company is aiming to raise Rs 6,600 crore through the listing which, at the higher end of the price band of Rs 95 to Rs 100 per share, will give it a valuation of Rs 62,332 crore. While there is no doubt that as a venture funded startup, Groww has had a fantastic run in the last decade, there are some challenges awaiting the company in the coming years.

Concentrated on broking

Groww is still largely reliant on trading and broking for its revenue. While the company has diversified its business operations beyond stock trading, stocks and exchange traded funds (ETFs) account for 72% of the business while mutual fund distribution comprises 50%. It has only recently ventured into the wealth management space through the acquisition of PayU-backed Fisdom. The sector is already getting crowded with Angel One-backed Ionic Wealth, publicly listed 360 One WAM, and well-funded startups like Dezerv and Centricity trying to grab a chunk of the market.

ET had reported on Tuesday that increasing competition in this sector is causing a strain in terms of trained investment professionals in the country. Average salaries of highly specialised relationship managers are up by 50% to 100%, resulting in increased operating expenses for wealth platforms.

Also, unlike trading, which is mostly do-it-yourself, wealth management is a relationship-driven business, where Groww will have to realign its business DNA.

Lalit Keshre, chief executive officer of Groww had told ET recently that the company is looking to build offline distribution capabilities, a new area for the startup.

Secondly, the regulator is cracking down on excessive speculative trading. The impact showed up in its June-quarter numbers--its operating revenue stood at Rs 904 crore compared with Rs 1,000 crore a year ago.

In a note released on October 29, institutional equities research firm Nuvama said it expects a 5% drop in its futures and options orders, which can drag Groww’s revenues by 2.5% and profit after taxes by 4.4%.

"If you look at Groww, we actually grew in that time (after Sebi's rules around F&O) and between Q1FY25 to Q1FY26 our revenues are down, but 10%, not 40% like others. Why? Because our non-derivative business has been growing very, very fast. Besides, our market share in derivatives is growing," Keshre told ET on October 30.

Started small

In 2016, when Groww started operations, it went after mutual funds--the easiest wealth product available in the market. Around 2017, the Association of Mutual Funds in India (AMFI) had started the mutual fund promotional campaign and direct mutual fund distribution was gaining popularity. A direct distribution platform does not charge the customer for mutual fund purchases.

While the industry leaders then--FundsIndia, Scripbox and others--focused on revenue generation and remained as regular platforms, Groww went direct and started chasing customers.

Between FY17 and FY20, Groww’s operating revenue remained between Rs 25 lakh and Rs 30 lakh, but its active user base grew quickly. There was competition from Zerodha’s Coin, ET Money and Paytm Money, but Groww managed to steal the show through steady growth.

Quick pivot to broking

In 2019, Groww secured stock broking licence from the Securities and Exchange Board of India (Sebi). As the trading market opened up during the pandemic years, Groww was at the right place at the right time. The stats show how fast Groww expanded its user base. In 2021, Zerodha had around 3.4 million active traders and Groww had 0.7 million. In September 2023, Groww pipped Zerodha to the top spot with 6.6 million active traders against Zerodha’s 6.4 million.

Aggressive brand building, coupled with user reviews talking about the experience on the Groww app, resulted in this virality. At around the same time, digital customer onboarding enabled by Sebi helped drive this growth.

“Investing is a close-knit community, hence, word travelled fast that first-time traders should try Groww, and that worked in their favour,” said a senior industry executive.

It also helped that Paytm and PhonePe remained focused on the banking and payments business, resulting in two very well-funded large fintechs giving the wealth management business a slip.

With broking business came the revenues and the profits. Groww closed FY25 with total revenue of more than Rs 4,000 crore and a net profit of Rs 1,819 crore.

Innovative marketing

This is perhaps the most talked about business strategy for Groww and has played a big role in brand-building. While Zerodha was focused on text-based educational portal Varsity and its own blogs at ZConnect, Groww seized the video-based marketing opportunity. The numbers say it all--Groww’s YouTube channel has 2.4 million subscribers compared with around 740,000 for Zerodha.

Keshre had said last month that the company never worked with financial influencers and preferred to reach out to investors directly. Currently, Groww has 18 million total transacting users, according to its prospectus.

While startups have been queuing up to join the public markets, Bengaluru-based Groww, founded in 2016, will be one of the youngest Indian fintech ventures to go public, joining the ranks of PB Fintech, Paytm and Mobikwik.

The company is aiming to raise Rs 6,600 crore through the listing which, at the higher end of the price band of Rs 95 to Rs 100 per share, will give it a valuation of Rs 62,332 crore. While there is no doubt that as a venture funded startup, Groww has had a fantastic run in the last decade, there are some challenges awaiting the company in the coming years.

Concentrated on broking

Groww is still largely reliant on trading and broking for its revenue. While the company has diversified its business operations beyond stock trading, stocks and exchange traded funds (ETFs) account for 72% of the business while mutual fund distribution comprises 50%. It has only recently ventured into the wealth management space through the acquisition of PayU-backed Fisdom. The sector is already getting crowded with Angel One-backed Ionic Wealth, publicly listed 360 One WAM, and well-funded startups like Dezerv and Centricity trying to grab a chunk of the market.

ET had reported on Tuesday that increasing competition in this sector is causing a strain in terms of trained investment professionals in the country. Average salaries of highly specialised relationship managers are up by 50% to 100%, resulting in increased operating expenses for wealth platforms.

Also, unlike trading, which is mostly do-it-yourself, wealth management is a relationship-driven business, where Groww will have to realign its business DNA.

Lalit Keshre, chief executive officer of Groww had told ET recently that the company is looking to build offline distribution capabilities, a new area for the startup.

Secondly, the regulator is cracking down on excessive speculative trading. The impact showed up in its June-quarter numbers--its operating revenue stood at Rs 904 crore compared with Rs 1,000 crore a year ago.

In a note released on October 29, institutional equities research firm Nuvama said it expects a 5% drop in its futures and options orders, which can drag Groww’s revenues by 2.5% and profit after taxes by 4.4%.

"If you look at Groww, we actually grew in that time (after Sebi's rules around F&O) and between Q1FY25 to Q1FY26 our revenues are down, but 10%, not 40% like others. Why? Because our non-derivative business has been growing very, very fast. Besides, our market share in derivatives is growing," Keshre told ET on October 30.

Started small

In 2016, when Groww started operations, it went after mutual funds--the easiest wealth product available in the market. Around 2017, the Association of Mutual Funds in India (AMFI) had started the mutual fund promotional campaign and direct mutual fund distribution was gaining popularity. A direct distribution platform does not charge the customer for mutual fund purchases.

While the industry leaders then--FundsIndia, Scripbox and others--focused on revenue generation and remained as regular platforms, Groww went direct and started chasing customers.

Between FY17 and FY20, Groww’s operating revenue remained between Rs 25 lakh and Rs 30 lakh, but its active user base grew quickly. There was competition from Zerodha’s Coin, ET Money and Paytm Money, but Groww managed to steal the show through steady growth.

Quick pivot to broking

In 2019, Groww secured stock broking licence from the Securities and Exchange Board of India (Sebi). As the trading market opened up during the pandemic years, Groww was at the right place at the right time. The stats show how fast Groww expanded its user base. In 2021, Zerodha had around 3.4 million active traders and Groww had 0.7 million. In September 2023, Groww pipped Zerodha to the top spot with 6.6 million active traders against Zerodha’s 6.4 million.

Aggressive brand building, coupled with user reviews talking about the experience on the Groww app, resulted in this virality. At around the same time, digital customer onboarding enabled by Sebi helped drive this growth.

“Investing is a close-knit community, hence, word travelled fast that first-time traders should try Groww, and that worked in their favour,” said a senior industry executive.

It also helped that Paytm and PhonePe remained focused on the banking and payments business, resulting in two very well-funded large fintechs giving the wealth management business a slip.

With broking business came the revenues and the profits. Groww closed FY25 with total revenue of more than Rs 4,000 crore and a net profit of Rs 1,819 crore.

Innovative marketing

This is perhaps the most talked about business strategy for Groww and has played a big role in brand-building. While Zerodha was focused on text-based educational portal Varsity and its own blogs at ZConnect, Groww seized the video-based marketing opportunity. The numbers say it all--Groww’s YouTube channel has 2.4 million subscribers compared with around 740,000 for Zerodha.

Keshre had said last month that the company never worked with financial influencers and preferred to reach out to investors directly. Currently, Groww has 18 million total transacting users, according to its prospectus.

Next Story